How Are Defined Benefit Plans Different From Defined Contribution Plans How Are They Similar

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Defined Benefit vs. Defined Contribution Plans: Unveiling the Key Differences and Similarities

What sets defined benefit and defined contribution plans apart, and where do they converge?

Understanding these retirement plan types is crucial for securing your financial future.

Editor’s Note: This comprehensive guide to defined benefit and defined contribution plans has been published today, offering up-to-date insights for individuals and businesses navigating retirement planning.

Why Understanding Defined Benefit and Defined Contribution Plans Matters

The choice between a defined benefit (DB) and a defined contribution (DC) retirement plan significantly impacts an individual's financial security in retirement. These plans represent fundamentally different approaches to retirement savings, each with its own set of advantages and disadvantages. Understanding these nuances is crucial for employers choosing the best plan for their workforce and for employees making informed decisions about their retirement savings strategy. The implications extend beyond individual financial planning, affecting broader economic trends and retirement preparedness across society.

Overview of the Article

This article will delve into the core differences and similarities between defined benefit and defined contribution plans. We will explore their structures, funding mechanisms, risk allocation, and overall impact on retirement security. Readers will gain a comprehensive understanding of each plan type, enabling informed decision-making regarding their own retirement planning or the selection of a retirement plan for their employees.

Research and Effort Behind the Insights

This analysis is based on extensive research, drawing from government publications (e.g., Department of Labor reports on retirement plans), academic studies on retirement savings behavior, and industry best practices compiled by organizations like the Society of Actuaries. The information provided aims to be accurate and up-to-date, reflecting current regulations and market trends.

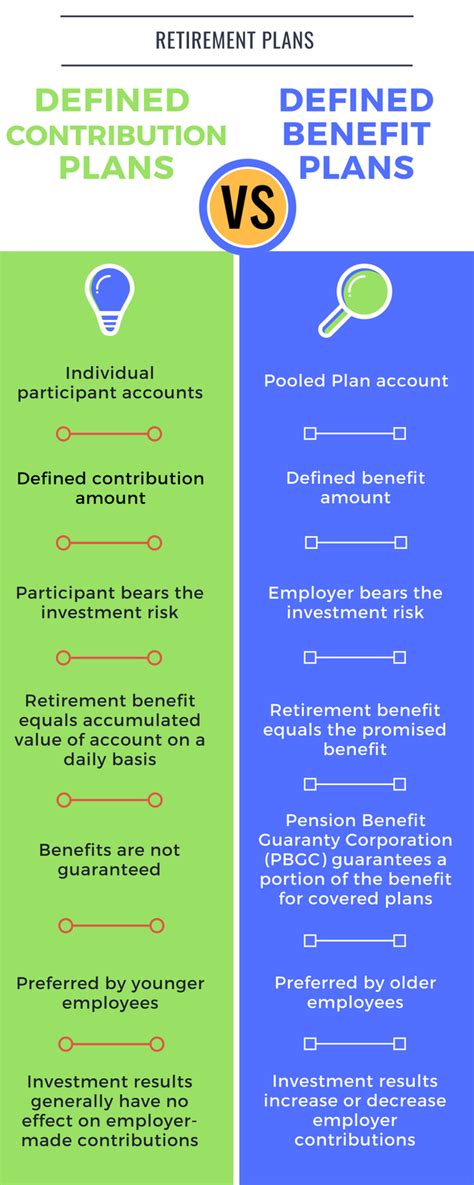

Key Differences and Similarities: A Summary

| Feature | Defined Benefit (DB) Plan | Defined Contribution (DC) Plan |

|---|---|---|

| Benefit Definition | Employer promises a specific monthly payment in retirement | Employee receives the accumulated value of contributions and investment earnings |

| Contribution | Employer determines and makes contributions | Employee and/or employer contributes a specified amount |

| Investment Risk | Employer bears the investment risk | Employee bears the investment risk |

| Portability | Generally not portable; benefits tied to the employer | Highly portable; assets can be transferred between employers |

| Transparency | Benefit calculation can be complex; future benefits uncertain | Contributions and account balance are readily visible |

| Regulation | Heavily regulated; subject to stringent funding requirements | Less stringent regulation; primarily governed by ERISA |

Smooth Transition to Core Discussion

Let's now dissect the core characteristics of defined benefit and defined contribution plans, examining their mechanics, advantages, and drawbacks in detail.

Exploring the Key Aspects of Defined Benefit and Defined Contribution Plans

-

Contribution Structure: In DB plans, the employer determines and makes contributions necessary to fund the promised retirement benefits. Contribution amounts can fluctuate based on actuarial valuations and the plan's funding status. In contrast, DC plans involve pre-determined contributions from the employee, employer, or both. The contribution amount is usually a fixed percentage of the employee's salary or a set dollar amount.

-

Benefit Structure: DB plans promise a specific monthly payment upon retirement, calculated using a formula that often considers factors like years of service and final salary. This provides retirees with a guaranteed income stream. DC plans, on the other hand, offer no guaranteed income. The retiree's benefits depend entirely on the accumulated value of contributions (both employee and employer) plus investment earnings (or losses) over the employee's working career.

-

Investment Risk Allocation: The employer assumes the investment risk in a DB plan. They are responsible for ensuring that sufficient funds are available to meet the promised benefit obligations. This responsibility often involves complex actuarial calculations and investment management strategies to mitigate risks. In a DC plan, the investment risk is borne entirely by the employee. They have the flexibility to choose how their contributions are invested, but also bear the full consequences of any investment gains or losses.

-

Portability and Plan Administration: DB plans are generally not portable. Benefits are typically tied to employment with the specific company sponsoring the plan. This can present challenges for employees who change jobs frequently. DC plans are highly portable. Employees can typically roll over their accumulated assets into an IRA or another employer-sponsored plan when they leave their job. DC plans are generally less complex to administer than DB plans, reducing administrative burdens for employers.

-

Transparency and Predictability: DB plan benefits can be difficult to understand and predict, as they are dependent on complex actuarial calculations and factors such as interest rates and mortality tables. DC plans offer significantly greater transparency; contributions and account balances are readily visible to the employee.

Closing Insights

The choice between DB and DC plans presents a trade-off between risk and predictability. DB plans offer guaranteed income in retirement but are less common today due to the significant financial obligations for employers. DC plans place the investment risk on the employee, providing greater flexibility and portability but with less predictable retirement income.

Exploring the Connection Between Investment Strategies and Retirement Plan Types

The investment strategy employed significantly influences the outcome of both DB and DC plans. In DB plans, the employer's investment decisions directly affect the plan's funding status and ability to meet benefit obligations. Conservative investment strategies minimize risk but might not generate sufficient returns to meet long-term obligations. Aggressive strategies might enhance returns but increase the risk of underfunding.

In DC plans, the employee's investment choices determine the eventual retirement nest egg. The employee's risk tolerance, investment knowledge, and time horizon should guide their investment strategy. A younger employee might tolerate more risk, investing in equities for higher potential returns, while an older employee closer to retirement might prefer a more conservative approach focusing on fixed-income investments to preserve capital.

Further Analysis of Investment Risk Allocation

| Aspect | Defined Benefit Plan | Defined Contribution Plan |

|---|---|---|

| Risk Bearer | Employer | Employee |

| Risk Mitigation Strategies | Actuarial valuations, diversification, hedging strategies | Diversification, asset allocation, risk tolerance assessment |

| Impact of Market Fluctuations | Significant impact on funding status; requires adjustments | Directly impacts account balance; requires active management |

| Potential for Loss | Employer bears the potential for losses; may impact funding | Employee bears the potential for losses; may impact retirement savings |

FAQ Section

-

Q: Which plan is better for me? A: The optimal choice depends on individual circumstances, risk tolerance, and long-term financial goals. Consider your age, risk tolerance, and the level of guaranteed income you desire.

-

Q: Can I switch from a DB to a DC plan? A: Typically, you cannot directly switch between these plans within the same employer.

-

Q: What happens if my employer goes bankrupt with a DB plan? A: Government agencies like the Pension Benefit Guaranty Corporation (PBGC) in the US may provide some protection, but benefits may be reduced.

-

Q: How are contributions taxed in each plan? A: Contributions to DC plans are often tax-deferred, meaning taxes are paid upon withdrawal in retirement. DB plan contributions are typically not taxed until benefits are received.

-

Q: What are the fees associated with each plan? A: DB plans have administrative costs borne by the employer. DC plans may have investment management fees and administrative costs associated with the plan provider.

-

Q: What if I need to withdraw money early from my DC plan? A: Early withdrawals from DC plans are generally subject to penalties and taxes unless specific exceptions apply.

Practical Tips for Employees

-

Understand your plan: Familiarize yourself with the details of your employer's retirement plan.

-

Contribute regularly: Make regular contributions to your DC plan to maximize tax advantages and compound returns.

-

Diversify your investments: Spread your investments across different asset classes to reduce risk.

-

Rebalance periodically: Adjust your portfolio's asset allocation to maintain your desired level of risk.

-

Seek professional advice: Consult with a financial advisor for personalized retirement planning.

-

Monitor your progress: Track your retirement savings and investment performance regularly.

-

Plan for potential longevity: Account for the possibility of living longer than expected.

-

Consider additional savings: Explore options for supplemental retirement savings outside of your employer-sponsored plan.

Final Conclusion

Defined benefit and defined contribution plans represent distinct approaches to retirement savings, each offering a unique balance of risk and reward. DB plans offer the security of guaranteed income but are less prevalent today. DC plans, while placing the investment risk squarely on the employee, provide greater flexibility and portability. Understanding the core differences and similarities is crucial for employers selecting a plan and for employees making informed decisions about their financial future. By actively engaging in your retirement planning, regardless of the plan type, you can significantly enhance your financial security in retirement. The journey to retirement security requires thoughtful planning, diligent savings, and a proactive approach to investment management.

Latest Posts

Latest Posts

-

New Indications Definition

Apr 01, 2025

-

New Home Sales Definition

Apr 01, 2025

-

What Is New Growth Theory Definition How Its Used And Example

Apr 01, 2025

-

New Fund Offer Nfo Definition Types Launches And Benefits

Apr 01, 2025

-

New Economy Definition History Examples Of Companies

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about How Are Defined Benefit Plans Different From Defined Contribution Plans How Are They Similar . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.