How Are Options Contracts Priced

adminse

Mar 28, 2025 · 9 min read

Table of Contents

Unlocking the Mystery: How Options Contracts Are Priced

What makes options pricing so complex, yet so crucial to understand?

Options pricing models provide a powerful framework for navigating the intricate world of derivatives, offering invaluable insights into risk management and strategic trading.

Editor’s Note: This comprehensive guide to options contract pricing has been published today.

Why Options Pricing Matters

Options contracts, derivatives granting the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a specific price (strike price) on or before a specific date (expiration date), are fundamental tools in modern finance. Understanding their pricing is critical for several reasons:

- Risk Management: Options are widely used for hedging against price fluctuations in underlying assets, whether stocks, commodities, or currencies. Accurate pricing is essential for determining the appropriate hedge size and minimizing risk exposure.

- Investment Strategies: Options offer a range of sophisticated investment strategies beyond simple buying or selling. Options pricing models enable investors to evaluate the potential profitability and risk of complex strategies like covered calls, protective puts, and straddles.

- Market Making: Market makers rely on accurate options pricing models to set fair prices and manage their inventory. Mispricing can lead to significant financial losses.

- Portfolio Management: Sophisticated portfolio managers use options to adjust the risk and return profile of their portfolios, dynamically managing exposure to various market factors. Understanding options pricing is therefore paramount for effective portfolio construction and optimization.

- Financial Modeling: Options pricing plays a crucial role in various financial models, including those used for valuation, risk assessment, and derivative pricing within larger financial instruments.

Overview of the Article

This article delves into the core principles of options pricing, examining both the theoretical foundations and practical applications. We will explore the Black-Scholes model, its assumptions, and limitations, and discuss alternative models used for pricing options with different characteristics. Readers will gain a comprehensive understanding of the factors influencing options prices and the tools used to calculate them.

Research and Effort Behind the Insights

This article draws upon extensive research, incorporating theoretical models, empirical studies, and real-world market data. The insights presented reflect a rigorous analysis of the literature on options pricing, ensuring accuracy and relevance for both novice and experienced readers.

Key Takeaways

| Aspect | Description |

|---|---|

| Underlying Asset Price | A crucial factor; higher prices generally lead to higher call option prices and lower put option prices. |

| Strike Price | The price at which the option can be exercised; influences the option's intrinsic and time value. |

| Time to Expiration | The remaining time until the option expires; longer time generally increases option value (time decay). |

| Volatility | Measures the fluctuation of the underlying asset's price; higher volatility increases option value. |

| Interest Rates | Higher interest rates generally increase call option prices and decrease put option prices. |

| Dividends | For stock options, expected dividends decrease call option prices and increase put option prices. |

Smooth Transition to Core Discussion

Let's now delve into the intricacies of options pricing, beginning with the foundational Black-Scholes model and its evolution.

Exploring the Key Aspects of Options Pricing

-

The Black-Scholes Model: This Nobel Prize-winning model is the cornerstone of options pricing. It provides a theoretical framework for calculating the fair value of European-style options (options that can only be exercised at expiration). The model relies on several key inputs: the current price of the underlying asset, the strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset.

-

Assumptions of the Black-Scholes Model: It's crucial to understand that the Black-Scholes model makes several simplifying assumptions, including: constant volatility, no dividends, European-style exercise, efficient markets, and no transaction costs. These assumptions rarely hold perfectly in the real world, leading to limitations in the model's accuracy.

-

Limitations of the Black-Scholes Model: Real-world markets are far from perfectly efficient. Volatility is not constant; it changes over time, often dramatically. Dividends are paid on many underlying assets, impacting option prices. The model also struggles to accurately price options with early exercise features (American-style options).

-

Beyond Black-Scholes: Alternative Models: Various alternative models address the limitations of the Black-Scholes model. These include models that incorporate stochastic volatility (allowing volatility to change randomly), jump diffusion models (accounting for sudden price jumps), and binomial and trinomial trees (providing discrete-time approximations).

-

Greeks: Measuring Option Sensitivity: The "Greeks" are a set of measures that quantify the sensitivity of an option's price to changes in the underlying asset's price, volatility, time to expiration, and interest rates. Understanding the Greeks is essential for risk management and option trading strategies. Key Greeks include Delta, Gamma, Vega, Theta, and Rho.

-

Implied Volatility: Implied volatility is the market's expectation of future volatility, extracted from current option prices. It differs from historical volatility (the statistical measure of past price fluctuations). Traders use implied volatility to gauge market sentiment and adjust their strategies.

Closing Insights

Options pricing is a complex but critical area of finance. While the Black-Scholes model provides a fundamental framework, its limitations highlight the need for more sophisticated models that account for real-world market dynamics. Understanding the various pricing models, their assumptions, and their limitations is crucial for effective risk management, investment strategies, and informed decision-making in the options market. The use of the Greeks and an understanding of implied volatility allows traders to better manage risks and potential profits.

Exploring the Connection Between Volatility and Options Pricing

Volatility, a measure of price fluctuation, plays a pivotal role in options pricing. Higher volatility increases the probability of large price movements in the underlying asset, leading to a higher chance of the option finishing in the money (profitable). This increased probability directly translates to a higher option price. Conversely, lower volatility implies less price fluctuation, reducing the likelihood of a profitable outcome and thus decreasing the option's value.

Roles and Real-World Examples: Volatility's impact is visible in periods of market uncertainty or significant news events. During times of high volatility, like the COVID-19 market crash, option prices often skyrocket, reflecting the increased uncertainty and potential for extreme price movements.

Risks and Mitigations: Overestimating or underestimating volatility can significantly impact option trading strategies. Overestimating can lead to overpaying for options, while underestimating can expose traders to unexpected losses. Using sophisticated models that account for stochastic volatility and employing robust risk management techniques can help mitigate these risks.

Impact and Implications: Accurate volatility forecasting is crucial for effective options trading and hedging. Sophisticated quantitative models, alongside qualitative assessments of market sentiment, are employed to improve forecasting accuracy and reduce reliance on historical volatility alone.

Further Analysis of Volatility

Volatility clustering, a phenomenon where periods of high volatility are followed by more high volatility, and vice versa, challenges the constant volatility assumption of the Black-Scholes model. This clustering is often linked to market sentiment and news events.

Cause-and-Effect Relationships: News events, economic data releases, and changes in market sentiment directly influence volatility. Positive news can increase investor confidence, lowering volatility, while negative news can heighten uncertainty, driving volatility upward.

Significance and Applications: Understanding volatility clustering allows traders to better time their option trades and adjust their strategies accordingly. Models that incorporate stochastic volatility are better equipped to handle these fluctuations, providing more accurate pricing and risk assessment.

| Volatility Factor | Impact on Option Prices | Example |

|---|---|---|

| Increased Volatility | Higher option prices (both calls and puts) | Market crash due to unforeseen geopolitical events |

| Decreased Volatility | Lower option prices (both calls and puts) | Period of economic stability and low uncertainty |

| Volatility Clustering | Fluctuations in option prices reflecting volatility clusters | A series of high-volatility days following an initial market shock |

| Implied vs. Historical | Discrepancies indicate market sentiment and future expectations | Implied volatility significantly higher than historical volatility suggests fear |

FAQ Section

-

Q: What is the difference between American and European options? A: American options can be exercised at any time before expiration, while European options can only be exercised at expiration.

-

Q: How does time decay affect option prices? A: Time decay, also known as theta, erodes the value of an option as it approaches its expiration date. The closer to expiration, the faster the decay.

-

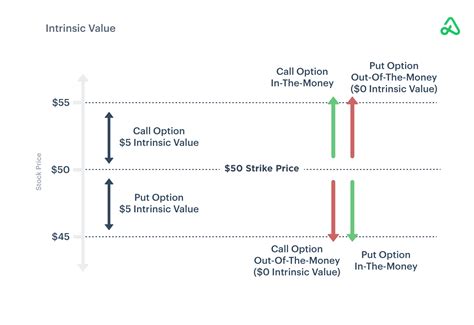

Q: What is intrinsic value? A: Intrinsic value is the difference between the underlying asset's price and the strike price. A call option has intrinsic value only when the underlying price exceeds the strike price, while a put option has intrinsic value when the underlying price is below the strike price.

-

Q: What is extrinsic value? A: Extrinsic value is the portion of an option's price that is not intrinsic value; it represents the time value and the market's expectation of future volatility.

-

Q: How can I use options for hedging? A: Options can be used to hedge against price fluctuations. For example, a protective put can limit potential losses on a stock position, while a covered call can generate income from an existing long position.

-

Q: Are there any free options pricing calculators available online? A: Yes, many websites and financial platforms offer free options pricing calculators. However, remember that the accuracy of these calculators depends on the input parameters and the underlying model used.

Practical Tips

-

Understand the underlying asset: Before trading options, thoroughly research the underlying asset, its price history, and its volatility.

-

Define your risk tolerance: Options trading can be risky; determine your risk tolerance before engaging in any trades.

-

Use options pricing models cautiously: While models are valuable tools, they are not perfect predictors of future prices.

-

Monitor market conditions: Keep track of news events and market conditions that may impact volatility and option prices.

-

Diversify your portfolio: Don't put all your eggs in one basket; diversify your portfolio to spread out risk.

-

Consider using stop-loss orders: Limit potential losses by setting stop-loss orders to automatically exit a position if the price falls below a certain level.

-

Backtest your strategies: Test your option trading strategies using historical data before deploying them with real money.

-

Seek professional advice: Consult with a financial advisor for personalized advice on options trading.

Final Conclusion

Options pricing is a multifaceted field requiring a strong understanding of both theoretical models and market dynamics. While the Black-Scholes model forms the basis, its limitations emphasize the need for more sophisticated approaches. By understanding the key factors influencing option prices, the various pricing models, and the practical implications of volatility, traders can make more informed decisions and navigate the complexities of the options market effectively. Continuous learning and careful risk management are essential for success in this dynamic and challenging arena. The insights provided in this comprehensive guide offer a solid foundation for further exploration and a deeper understanding of this critical aspect of modern finance.

Latest Posts

Latest Posts

-

Put Swaption Definition

Mar 31, 2025

-

Put Provision Definition

Mar 31, 2025

-

Why Does Credit One Bank Keep Calling Me

Mar 31, 2025

-

What Is Credit Protection Credit One

Mar 31, 2025

-

Put On A Put Definition

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about How Are Options Contracts Priced . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.