How Do Options Contracts Work

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Unlocking the Power of Options Contracts: A Comprehensive Guide

What makes understanding options contracts so crucial in today's financial markets?

Options contracts are a powerful tool for managing risk and generating profit, offering sophisticated strategies for both seasoned investors and newcomers alike.

Editor’s Note: This comprehensive guide to options contracts was published today, providing you with the latest insights and strategies.

Why Options Contracts Matter

Options contracts represent a significant element within the broader financial landscape. Their importance stems from their ability to provide investors with flexibility and control they wouldn't otherwise possess. Unlike straightforward stock purchases, options allow investors to define their risk exposure and potential rewards, tailoring their investment approach to specific market conditions and personal risk tolerance. This adaptability makes options relevant across diverse asset classes, including stocks, indices, currencies, and commodities. Understanding options contracts empowers individuals to participate more actively and strategically in the market, potentially enhancing returns while mitigating losses. For businesses, options can be used for hedging purposes, mitigating potential risks from fluctuating prices of raw materials or currencies.

Overview of the Article

This article will explore the fundamental mechanics of options contracts, clarifying terminology, explaining different types of options, and outlining various trading strategies. Readers will gain a comprehensive understanding of how these instruments work, their associated risks and benefits, and practical steps for incorporating options into their investment portfolios. We'll delve into real-world examples, illustrative scenarios, and detailed explanations to demystify this often-complex financial tool.

Research and Effort Behind the Insights

The information presented in this article is based on extensive research encompassing academic literature on options pricing, practical experience in trading options, analysis of market data, and reference to reputable financial resources. The goal is to provide a clear, accurate, and actionable guide for readers seeking to improve their understanding of options contracts.

Key Takeaways

| Key Concept | Explanation |

|---|---|

| Options Contract Basics | Agreement granting the right, but not the obligation, to buy or sell an underlying asset at a specific price. |

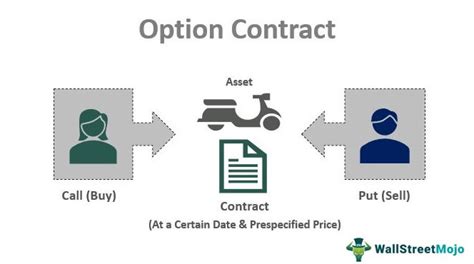

| Call vs. Put Options | Call: Right to buy; Put: Right to sell. |

| Strike Price & Expiration | Price at which the option can be exercised; date when the option expires. |

| Premium & Intrinsic Value | Price paid for the option; the difference between the strike price and the underlying asset's current price. |

| Risk Management Applications | Hedging, speculation, income generation. |

Smooth Transition to Core Discussion

Let's delve into the core components of options contracts, beginning with a definition and a breakdown of the key terminology.

Exploring the Key Aspects of Options Contracts

-

Understanding the Basics: Options contracts are derivatives—their value is derived from an underlying asset, such as a stock, index, or commodity. A call option gives the holder the right, but not the obligation, to buy the underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). A put option grants the holder the right, but not the obligation, to sell the underlying asset at the strike price on or before the expiration date.

-

Call Option Example: Imagine a call option on XYZ stock with a strike price of $100 and an expiration date of December 31st. If the price of XYZ stock rises above $100 before December 31st, the option holder can exercise their right to buy the stock at $100, even if the market price is higher. They then profit from the difference between the market price and the strike price, less the premium they initially paid for the option. If the price stays below $100, the option expires worthless, and the holder only loses the premium.

-

Put Option Example: A put option on XYZ stock with a strike price of $100 and an expiration date of December 31st allows the holder to sell the stock at $100, regardless of the market price. If the stock price falls below $100, the holder can buy the stock at the lower market price and sell it at $100, profiting from the difference (minus the premium). If the price remains above $100, the option expires worthless.

-

Option Premiums: The price paid to acquire an option is called the premium. This premium reflects the market's assessment of the option's value, considering factors like the underlying asset's price, volatility, time to expiration, and interest rates. Options pricing models, such as the Black-Scholes model, are used to estimate these premiums.

-

Intrinsic Value and Time Value: The intrinsic value of an option is the amount by which the option is "in the money." For a call option, this is the amount by which the underlying asset's price exceeds the strike price. For a put option, it's the amount by which the strike price exceeds the underlying asset's price. Time value represents the potential for the option to become more valuable as the expiration date approaches. The premium is the sum of intrinsic value and time value.

Closing Insights

Options contracts provide investors with a flexible and powerful tool for managing risk and potentially enhancing returns. By understanding the nuances of call and put options, strike prices, expiration dates, and premiums, investors can develop strategies tailored to their specific risk tolerance and market outlook. The ability to define risk exposure and potential profits sets options apart from other investment vehicles. However, it’s crucial to remember that options trading involves significant risk, and a thorough understanding of the mechanics and potential losses is paramount before engaging in any options trading.

Exploring the Connection Between Risk Management and Options Contracts

Options contracts play a crucial role in risk management. Hedging strategies, utilizing options to mitigate potential losses from adverse price movements, are commonly employed by businesses and individual investors. For example, a farmer expecting to sell their harvest in the future might buy put options to protect against a decline in crop prices. If prices fall below the strike price, the farmer can exercise the put options, effectively locking in a minimum selling price. Similarly, an importer could buy call options to hedge against increases in the price of a foreign currency.

Further Analysis of Risk Management with Options

| Risk Mitigation Strategy | Description | Example |

|---|---|---|

| Hedging with Puts | Protecting against price declines by buying put options on the underlying asset. | Farmer buying put options on corn to protect against price drops. |

| Hedging with Calls | Protecting against price increases by selling call options (covered call writing). | Stock owner selling call options to generate income while limiting upside. |

| Collar Strategy | Limiting both upside and downside risk by buying puts and selling calls. | Protecting a stock portfolio from large swings in value. |

| Straddles & Strangles | Speculative strategies using both calls and puts with varying strike prices. | Betting on significant price movement (up or down) in the underlying asset. |

FAQ Section

-

What is the difference between a long and short option position? A long position means you've bought the option, giving you the right to buy (call) or sell (put). A short position means you've sold the option, obligating you to buy (if it's a put) or sell (if it's a call) if the option is exercised.

-

How do options expire? Options expire on their expiration date. If they are "out of the money" (the price movement doesn't favor exercising the option), they expire worthless.

-

What are the risks involved in options trading? Options trading carries significant risk of losing the entire premium paid. There's also the risk of assignment (being obligated to buy or sell the underlying asset if you've sold an option).

-

Are options suitable for all investors? No, options trading is complex and carries significant risk. It's generally not suitable for beginners without a solid understanding of financial markets.

-

Where can I learn more about options trading? Reputable online resources, educational platforms, and brokerage firms offer courses and materials on options trading.

-

How can I manage risk in options trading? Diversification, proper position sizing, and using stop-loss orders are crucial risk management techniques in options trading.

Practical Tips

-

Start with Education: Thoroughly understand options basics before trading.

-

Paper Trade: Practice with simulated trading accounts to gain experience without risking real money.

-

Understand Volatility: Volatility significantly impacts option prices.

-

Manage Risk: Use stop-loss orders and diversify your options portfolio.

-

Define Your Strategy: Have a clear plan before entering any options trade.

-

Monitor Your Positions: Regularly track the performance of your options trades.

-

Learn from Mistakes: Analyze successful and unsuccessful trades to improve your strategy.

-

Seek Professional Advice: If needed, consult with a financial advisor experienced in options trading.

Final Conclusion

Options contracts represent a sophisticated yet valuable investment tool. By understanding their mechanics, associated risks, and diverse applications in risk management and profit generation, investors can leverage their potential for strategic advantage in the market. While options trading involves inherent risks, a thorough understanding, coupled with prudent risk management practices, can unlock the considerable opportunities this instrument offers. Continued learning and practical experience are essential for mastering options trading and realizing its full potential. The information provided here serves as a foundation; further research and hands-on experience are vital for successful navigation of this complex but rewarding aspect of the financial world.

Latest Posts

Latest Posts

-

Why Does Credit One Bank Keep Calling Me

Mar 31, 2025

-

What Is Credit Protection Credit One

Mar 31, 2025

-

Put On A Put Definition

Mar 31, 2025

-

Put Calendar Definition

Mar 31, 2025

-

What Credit Bureau Does Affirm Use

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about How Do Options Contracts Work . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.