How Does Hedging Decrease Future Income Tax

adminse

Mar 31, 2025 · 10 min read

Table of Contents

How Hedging Decreases Future Income Tax: A Comprehensive Guide

What is the secret to minimizing your future tax burden while still achieving your financial goals?

Strategic hedging offers a powerful, often overlooked, tool for significantly reducing future income tax liabilities.

Editor’s Note: This comprehensive guide to how hedging decreases future income tax has been published today.

Why Hedging Matters for Tax Reduction

In today's volatile economic environment, uncertainty is the only constant. Fluctuations in currency exchange rates, interest rates, commodity prices, and equity markets can dramatically impact a company's or individual's future income and, consequently, their tax liability. Hedging provides a mechanism to mitigate these risks, leading to a more predictable and potentially lower tax burden. Understanding how hedging strategies work and their implications for tax planning is crucial for businesses and high-net-worth individuals seeking to optimize their financial outcomes. This impacts not only corporate tax strategies but also personal income tax liabilities for those with significant investments in volatile assets. The potential for tax savings makes hedging a powerful financial planning tool.

Overview of the Article

This article explores the various ways hedging can decrease future income tax. We'll examine different hedging instruments, their application in various scenarios, and the tax implications associated with their use. Readers will gain a deeper understanding of how hedging can create a more favorable tax position, along with a clear understanding of the complexities and potential pitfalls involved. We will delve into specific examples and case studies to illustrate the practical applications of this strategy.

Research and Effort Behind the Insights

This article draws upon extensive research from reputable sources, including academic journals, industry publications, and consultations with tax professionals specializing in financial hedging strategies. The information provided is intended for educational purposes and should not be considered as financial or tax advice. Consult with qualified professionals before implementing any hedging strategies.

Key Takeaways

| Key Insight | Explanation |

|---|---|

| Hedging reduces income volatility. | By mitigating risks associated with fluctuating asset prices, hedging creates more predictable income streams, leading to better tax planning. |

| Hedging can defer tax liabilities. | By locking in prices or rates, hedging can postpone tax payments to future years, potentially benefiting from lower tax rates or tax breaks. |

| Hedging can create tax-deductible expenses. | The costs associated with hedging strategies can often be deducted from taxable income, further reducing the overall tax burden. |

| Hedging requires specialized knowledge. | Implementing effective hedging strategies requires a deep understanding of financial markets and tax laws. Professional advice is often necessary. |

| Hedging isn't without risks or costs. | Hedging strategies are not risk-free. They involve costs and may not perfectly offset all potential losses. |

| Hedging effectiveness depends on market conditions | The success of a hedging strategy depends on the accuracy of market predictions and the specific instruments used. |

Smooth Transition to Core Discussion

Let's delve into the specifics of how hedging techniques minimize future income tax, beginning with an understanding of different hedging instruments and their applications.

Exploring the Key Aspects of Hedging for Tax Reduction

- Understanding Hedging Instruments: Various financial instruments are used for hedging, including futures contracts, options, swaps, and forwards. Each has unique characteristics and is suitable for different types of risks.

- Tax Implications of Hedging Strategies: The tax treatment of hedging strategies varies considerably depending on jurisdiction, the specific instrument used, and the taxpayer's circumstances. Careful consideration of tax regulations is crucial.

- Case Studies and Real-World Examples: Illustrative examples will demonstrate how hedging strategies have been employed to successfully minimize tax liabilities in diverse business scenarios.

- Risk Management and Tax Optimization: Balancing the desire for tax reduction with effective risk management is key to successful hedging. An overly aggressive approach can backfire.

- Choosing the Right Hedging Strategy: The selection of an appropriate hedging strategy involves a careful assessment of the specific risks faced and the available hedging instruments.

- Long-Term Tax Planning with Hedging: Integrating hedging strategies into long-term tax planning can deliver substantial benefits, providing a more predictable and favorable tax position over time.

Understanding Hedging Instruments

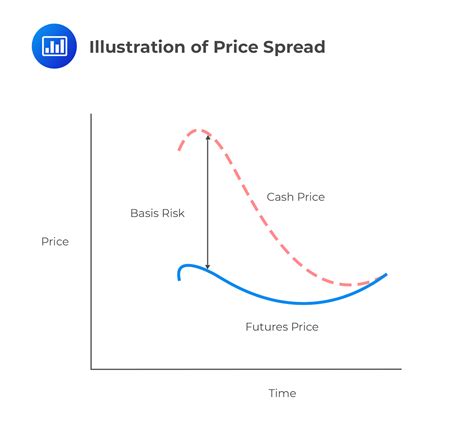

- Futures Contracts: Agreements to buy or sell an asset at a predetermined price on a future date. These are effective for hedging against price volatility in commodities, currencies, and interest rates. The tax treatment of futures contracts involves considering gains and losses as capital gains or losses, depending on the holding period.

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell an asset at a specific price within a certain timeframe. Options provide flexibility and can be used to define downside protection or to capitalize on potential upside gains. The tax treatment of options involves complex rules, with gains and losses potentially treated as ordinary income or capital gains/losses depending on the specific strategy.

- Swaps: Agreements to exchange cash flows based on the performance of two different assets. Swaps are commonly used to hedge interest rate risk or currency exchange rate risk. The tax treatment of swaps involves treating the cash flows as either interest income or expenses, or capital gains/losses.

- Forwards: Similar to futures contracts, but they are customized agreements traded over-the-counter, offering greater flexibility. The tax treatment is generally similar to futures contracts, involving treatment as capital gains/losses.

Tax Implications of Hedging Strategies

The tax treatment of hedging strategies can be complex and varies significantly depending on various factors. In general, gains and losses from hedging transactions are treated differently based on the classification of the underlying asset (e.g., capital assets vs. ordinary income assets). Additionally, the holding period of the hedging instrument can significantly impact tax rates. Some jurisdictions allow for specific tax deductions associated with hedging costs, further reducing the tax burden. However, tax regulations may differ across countries, so consulting with a tax advisor is essential to understand the relevant rules in a specific jurisdiction. Misunderstanding the tax implications can negate any benefits from a hedging strategy.

Case Studies and Real-World Examples

Consider a hypothetical example of an agricultural exporter. This exporter anticipates selling a large quantity of wheat in six months. To hedge against the risk of a decline in wheat prices, they could purchase wheat futures contracts. If wheat prices fall, the gains on the futures contracts will offset the losses on the sale of their wheat, protecting their profit margin. The tax advantage arises from the ability to offset potential capital losses on wheat sales with capital gains realized on futures contracts.

Similarly, a multinational corporation might use currency swaps to hedge against exchange rate fluctuations. If the company expects to receive payments in a foreign currency, they could enter into a swap agreement to exchange the foreign currency for their domestic currency at a fixed rate. This protects against adverse movements in exchange rates, ensuring predictable income streams, and influencing their tax liabilities favorably.

Risk Management and Tax Optimization

While hedging can significantly reduce tax liabilities, it’s not a guaranteed method to eliminate all risk. Hedging strategies themselves carry risks, including the possibility of imperfect hedging and the associated transaction costs. The goal is to find a balance between effectively mitigating risks and minimizing tax liabilities. Overly aggressive hedging strategies can result in unintended tax consequences. Professional guidance is crucial to navigate these complexities and develop a tailored strategy.

Choosing the Right Hedging Strategy

The selection of an appropriate hedging strategy is crucial and depends on several factors. Understanding the nature and extent of the risks faced is paramount. A thorough analysis of the company's or individual's financial position, future income projections, and potential liabilities is essential for selecting appropriate hedging tools and techniques. The choice also depends on the underlying asset being hedged, the time horizon, and the investor's risk tolerance.

Long-Term Tax Planning with Hedging

Integrating hedging strategies into a long-term tax planning framework is vital to maximizing their benefits. This involves considering the interplay between hedging strategies and other tax-planning techniques, such as depreciation, tax credits, and investment deductions. A holistic approach ensures that hedging becomes a seamless component of a broader tax optimization strategy rather than an isolated action. This approach leads to a more predictable and potentially lower overall tax liability across multiple tax years.

Exploring the Connection Between Interest Rate Risk and Hedging

Interest rate risk poses a significant threat to businesses and individuals with substantial debt or investments sensitive to interest rate changes. Rising interest rates can increase borrowing costs, reduce the value of fixed-income investments, and impact overall profitability. Hedging strategies, such as interest rate swaps or options on interest rate futures, can help mitigate these risks. By locking in interest rates, companies can protect their profit margins and minimize the impact of interest rate volatility on their tax liability. This predictable interest expense creates a smoother cash flow forecast and allows for more precise tax planning.

Further Analysis of Interest Rate Risk

| Factor | Impact on Tax Liability | Mitigation Strategy |

|---|---|---|

| Rising Interest Rates | Increased interest expense, potentially reducing taxable income | Interest rate swaps, interest rate caps, or futures |

| Falling Interest Rates | Reduced interest income, potentially increasing taxable income | Interest rate floors |

| Unexpected Rate Changes | Income volatility, making accurate tax planning difficult | Hedging strategies to lock in rates |

FAQ Section

-

Q: Is hedging always tax-efficient? A: Not necessarily. The tax efficiency of a hedging strategy depends on various factors, including the specific instruments used, the applicable tax laws, and the overall market conditions. Professional advice is essential.

-

Q: Are hedging costs tax-deductible? A: Often, yes, but this depends on the tax laws of your jurisdiction and the nature of the hedging activity. Consult with a tax professional.

-

Q: Can individuals use hedging strategies? A: Yes, but typically for managing risks associated with investments in volatile assets like stocks or commodities. The complexity may warrant professional advice.

-

Q: How do I choose the right hedging strategy? A: This requires a detailed analysis of your specific circumstances, risk profile, and financial objectives. Professional help is strongly recommended.

-

Q: What are the risks associated with hedging? A: Imperfect hedging, transaction costs, and the potential for unforeseen market movements can all impact the effectiveness of a hedging strategy.

-

Q: Is hedging a guaranteed way to reduce taxes? A: No. Hedging helps manage risk, which can indirectly influence tax liabilities, but it doesn’t provide a guaranteed tax reduction.

Practical Tips for Implementing Hedging Strategies

- Consult with Financial and Tax Professionals: Seek expert advice to determine the most appropriate hedging strategies for your specific situation.

- Conduct Thorough Due Diligence: Carefully research different hedging instruments and their associated risks and costs.

- Develop a Comprehensive Risk Management Plan: Define your risk tolerance and objectives before implementing any hedging strategy.

- Monitor Market Conditions Regularly: Keep track of market trends and adjust your hedging strategy as needed.

- Maintain Accurate Records: Meticulously document all hedging transactions and their associated costs for tax purposes.

- Review and Evaluate Regularly: Periodically review your hedging strategy's effectiveness and make necessary adjustments.

- Understand Tax Implications: Ensure you understand the tax implications of your chosen hedging strategy before implementation.

- Consider Long-Term Goals: Integrate your hedging strategy into your overall long-term financial and tax planning.

Final Conclusion

Hedging offers a powerful tool for mitigating future income tax liabilities by reducing income volatility and providing opportunities for tax deductions. However, it's crucial to understand the complexities of different hedging instruments and their tax implications. This requires careful planning and often necessitates seeking professional financial and tax advice to ensure that the chosen strategy aligns with your overall financial goals and minimizes potential risks. Implementing hedging strategies effectively requires a thorough understanding of market dynamics, tax laws, and a careful assessment of individual circumstances. While not a guaranteed path to lower taxes, when properly executed, hedging can significantly improve the predictability and lower the overall tax burden over the long term. Proactive tax planning combined with strategic hedging forms a robust approach to navigating the complexities of taxation in today's uncertain economic landscape.

Latest Posts

Related Post

Thank you for visiting our website which covers about How Does Hedging Decrease Future Income Tax . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.