How Much Does The Bank Of America Rewards Program Pay For Each Purchase Using Credit Card

adminse

Mar 28, 2025 · 9 min read

Table of Contents

Unlocking the Rewards: A Deep Dive into Bank of America Credit Card Rewards

What determines the Bank of America rewards program payout for each purchase?

Bank of America's rewards programs offer a compelling blend of earning potential and valuable redemption options, but understanding the nuances is key to maximizing returns.

Editor’s Note: This comprehensive analysis of Bank of America credit card rewards programs was published today.

Why Bank of America Credit Card Rewards Matter

In today's competitive financial landscape, rewards programs are a significant factor influencing consumer choices. Bank of America (BofA), a major player in the US banking industry, offers a range of credit cards with varying rewards structures, catering to diverse spending habits and financial goals. Understanding the intricacies of their rewards programs is crucial for consumers seeking to maximize their spending power and reap substantial benefits. These programs directly impact personal finances, offering potential savings on everyday expenses or opportunities to achieve significant travel goals. The potential return on spending directly influences the overall value proposition of a BofA credit card.

Overview of the Article

This article delves into the intricacies of Bank of America's credit card rewards programs. We will dissect the different card types, outlining their respective rewards rates, bonus categories, and redemption options. The analysis will cover how rewards are calculated, potential pitfalls to avoid, and strategies for maximizing returns. Readers will gain a comprehensive understanding of how to choose the right card and optimize their earning potential. Finally, we will address frequently asked questions and provide practical tips for leveraging BofA's rewards programs effectively.

Research and Effort Behind the Insights

The information presented here is based on extensive research of Bank of America's official website, terms and conditions, and publicly available information on rewards programs. We have meticulously analyzed reward structures for various cards, considered bonus offers, and factored in redemption values. The analysis aims to provide an accurate and up-to-date overview, though it's crucial to refer to BofA's official website for the most current details as programs are subject to change.

Key Takeaways

| Key Aspect | Description |

|---|---|

| Reward Structure Variation | BofA offers diverse cards with varying rewards rates and bonus categories. |

| Points vs. Cash Back | Some cards offer points redeemable for travel or merchandise, while others provide straightforward cash back. |

| Redemption Options | Redemption methods vary, impacting the actual value received. |

| Bonus Categories | Many cards offer enhanced rewards rates for specific spending categories (e.g., groceries, gas, travel). |

| Annual Fees | Some cards charge annual fees, which must be weighed against potential rewards earned. |

| Earning Rate Calculation | Rewards are typically calculated as a percentage of purchases, with bonus categories offering higher percentages. |

Let's dive deeper into the key aspects of BofA credit card rewards, starting with an examination of the various card types and their associated rewards structures.

Exploring the Key Aspects of BofA Credit Card Rewards

-

Card Types and Their Rewards: Bank of America offers a broad spectrum of credit cards, from no-annual-fee options to premium cards with substantial benefits. Each card features a distinct rewards program. Some cards offer cash back, while others provide points redeemable for travel, merchandise, or statement credits. The type of rewards offered and the earning rates significantly influence the overall return.

-

Understanding Points and Cash Back: Cash back rewards are straightforward – a percentage of every purchase is credited back to the cardholder's account. Points-based programs are more complex, as points' value fluctuates depending on the redemption method. Points can be redeemed for cash back, travel rewards (flights, hotels), gift cards, or merchandise, but the value per point isn't always consistent.

-

Bonus Categories and Spending Optimization: Many BofA credit cards feature bonus categories, providing enhanced rewards rates for specific spending categories. This is where strategic spending plays a crucial role. By concentrating spending in bonus categories, cardholders can substantially increase their rewards earnings. For example, a card offering 3% cash back on groceries and 2% on gas can significantly boost rewards if a substantial portion of spending falls within these categories.

-

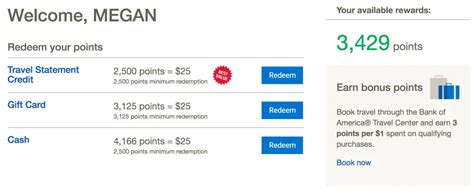

Redemption Options and Value Maximization: Understanding redemption options is key to maximizing the value of earned rewards. BofA offers various redemption pathways, each with varying return rates. Redeeming points for travel through their travel portal might offer higher value than redeeming for cash back, but careful comparison is crucial to ensure optimal value.

-

Annual Fees and Return on Investment: Some BofA credit cards charge annual fees. These fees must be carefully considered against the potential rewards earned. A card with a higher annual fee might be worthwhile if the rewards earned significantly outweigh the cost, but for less frequent spenders, a no-annual-fee card might be a better choice.

Closing Insights

Bank of America's credit card rewards programs offer a versatile range of options catering to various spending patterns and financial goals. However, maximizing rewards requires a thorough understanding of each card's specific features, including reward rates, bonus categories, and redemption methods. Strategic spending within bonus categories and choosing the right redemption option are critical for optimizing the value of earned rewards. Careful consideration of annual fees, if any, is equally important to ensure a positive return on investment. By meticulously analyzing these factors, consumers can leverage BofA's rewards programs to their fullest potential.

Exploring the Connection Between Credit Score and BofA Credit Card Rewards

A cardholder's credit score significantly influences the type of BofA credit card they qualify for and, consequently, the rewards program they can access. Higher credit scores often unlock access to premium cards with more lucrative rewards programs, including higher earning rates and more valuable bonus categories. Conversely, lower credit scores might limit access to premium cards, restricting opportunities for increased rewards. Maintaining a good credit score is therefore crucial for maximizing the potential of BofA's rewards programs. This underscores the interconnectedness between creditworthiness and the ability to benefit fully from credit card rewards. Real-world examples abound: individuals with excellent credit scores might qualify for a premium travel rewards card with substantial earning potential, whereas those with less-than-perfect credit might only be eligible for a basic cash-back card with limited rewards. This highlights the critical role of credit management in optimizing financial rewards.

Further Analysis of Credit Score Impact

The impact of a credit score on BofA credit card rewards is multifaceted. It affects not only the available cards but also the interest rates offered. A higher credit score typically translates to lower interest rates, which minimizes the overall cost of carrying a balance, enabling a greater proportion of spending to contribute towards reward accumulation. This further accentuates the importance of credit score management in maximizing financial benefits.

| Credit Score Range | Card Options | Interest Rate Range (Example) | Reward Potential |

|---|---|---|---|

| 750+ | Premium travel cards, cash back cards | Lower | High |

| 700-749 | Range of cards with varying rewards programs | Moderate | Moderate |

| Below 700 | Basic cards, limited reward options | Higher | Limited |

This table illustrates how credit scores influence the breadth of available cards and the associated interest rates, ultimately impacting overall reward earning potential.

FAQ Section

-

Q: How do I enroll in the Bank of America rewards program? A: Enrollment is typically automatic when you open a qualifying Bank of America credit card. However, it's advisable to check your account details online to ensure enrollment.

-

Q: What happens if I lose my credit card? A: Immediately report your lost or stolen card to Bank of America. They will cancel your card and issue a replacement. Your rewards points will typically be transferred to your new card.

-

Q: Can I combine points from different Bank of America credit cards? A: This depends on the specific cards you have. Some cards allow for points pooling, while others may not. Check the terms and conditions of your specific cards.

-

Q: What are the redemption limits? A: Redemption limits vary depending on the card and the chosen redemption method. Check your card's terms and conditions for details.

-

Q: How long does it take to receive my rewards? A: The timeframe depends on the redemption method. Cash back is generally credited to your account quickly, while other redemption options may take longer.

-

Q: What happens to my rewards if I close my account? A: Check your card's agreement. In many cases, unredeemed rewards may expire, so redeem points before closing the account.

Practical Tips

-

Track your spending: Monitor your spending to identify opportunities for maximizing rewards within bonus categories.

-

Utilize online tools: Use BofA's online tools and mobile app to track your rewards progress and manage your account.

-

Choose the right card: Select a card aligned with your spending habits and rewards preferences.

-

Understand redemption values: Compare redemption options before redeeming your rewards to maximize their value.

-

Consider annual fees: Weigh the potential rewards against the annual fee, if applicable.

-

Maintain good credit: A higher credit score unlocks access to more lucrative rewards programs.

-

Set redemption goals: Set specific goals for your rewards redemption, such as travel or merchandise purchases.

-

Stay informed: Regularly review your card's terms and conditions and stay updated on any changes to the rewards program.

Final Conclusion

Bank of America's credit card rewards programs provide significant opportunities for consumers to reap financial benefits from their everyday spending. However, maximizing the value of these rewards requires careful planning, strategic spending, and an understanding of the intricacies of each program. By following the practical tips outlined and diligently managing their accounts, cardholders can effectively leverage BofA's rewards systems to enhance their financial well-being. The journey to unlocking the full potential of these rewards is paved with informed decision-making and proactive account management. Continuously monitoring programs and adapting spending habits to maximize benefits is key to success.

Latest Posts

Latest Posts

-

New Indications Definition

Apr 01, 2025

-

New Home Sales Definition

Apr 01, 2025

-

What Is New Growth Theory Definition How Its Used And Example

Apr 01, 2025

-

New Fund Offer Nfo Definition Types Launches And Benefits

Apr 01, 2025

-

New Economy Definition History Examples Of Companies

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about How Much Does The Bank Of America Rewards Program Pay For Each Purchase Using Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.