How To Access Home Equity

adminse

Mar 31, 2025 · 9 min read

Table of Contents

Unlock Your Home's Value: A Comprehensive Guide to Accessing Home Equity

What are the best ways to tap into your home's equity, and how can you do it safely?

Accessing home equity strategically can be a powerful financial tool, offering opportunities for debt consolidation, home improvements, or even investments, but it requires careful planning and understanding.

Editor’s Note: This guide to accessing home equity has been published today to provide readers with the most up-to-date information and strategies.

Why Accessing Home Equity Matters

Your home represents a significant investment, and as you pay down your mortgage, you build equity – the difference between your home's value and what you owe on the mortgage. This equity can be a valuable financial resource, providing access to funds for various needs. Whether you're planning a major renovation, consolidating high-interest debts, funding your child's education, or investing in a business venture, understanding how to access your home equity safely and responsibly can unlock significant opportunities. Ignoring this valuable asset means missing out on potential financial advantages.

Overview of this Article

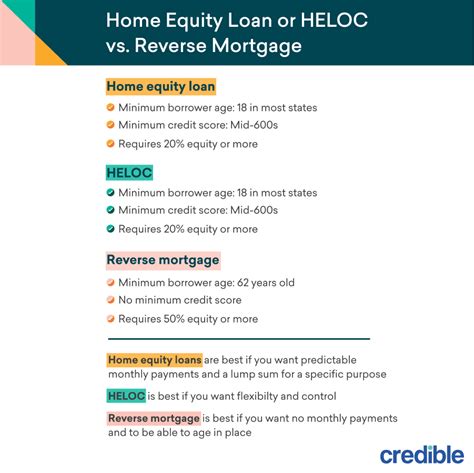

This article explores the various methods for accessing home equity, highlighting the advantages and disadvantages of each. We'll delve into the nuances of home equity loans, home equity lines of credit (HELOCs), cash-out refinancing, and reverse mortgages, providing a clear understanding of how they work and which option might be best suited to your individual circumstances. Readers will gain actionable insights and a comprehensive understanding of the process, enabling them to make informed decisions about leveraging their home equity.

Research and Effort Behind the Insights

This article is based on extensive research, incorporating information from reputable financial institutions, government agencies, and leading financial experts. We've analyzed data on interest rates, lending requirements, and market trends to ensure the accuracy and relevance of the information presented. The goal is to provide readers with clear, concise, and actionable advice.

Key Takeaways:

| Method | Pros | Cons | Suitability |

|---|---|---|---|

| Home Equity Loan | Fixed interest rate, predictable payments | Can be more expensive upfront due to closing costs, fixed loan amount | Large, one-time need with good credit |

| Home Equity Line of Credit (HELOC) | Variable interest rate, draw funds as needed, lower closing costs initially | Interest rates can fluctuate, potential for higher payments, draw period limit | Ongoing needs, flexible access to funds, good to excellent credit |

| Cash-Out Refinance | Lower interest rate than existing mortgage (potentially), simplified payments | Higher closing costs, increased loan amount, may require a higher credit score | Lower interest rates, simplifying multiple loans, good to excellent credit |

| Reverse Mortgage | Tax-free income, remain in your home, no monthly mortgage payments | High closing costs, decreasing equity over time, may affect inheritance | Seniors with limited income, need for supplemental funds |

Smooth Transition to Core Discussion:

Let's delve into the specifics of each method for accessing home equity, exploring the details, requirements, and considerations involved in making an informed decision.

Exploring the Key Aspects of Accessing Home Equity

-

Home Equity Loans: A home equity loan is a lump-sum loan secured by your home's equity. You receive the funds upfront and repay them over a fixed term with fixed monthly payments. The interest rate is typically fixed, offering predictability in your monthly budget. However, closing costs can be substantial.

-

Home Equity Lines of Credit (HELOCs): A HELOC operates more like a credit card, providing access to a revolving line of credit secured by your home's equity. You can borrow and repay funds as needed, up to a pre-approved credit limit. Interest rates are usually variable, meaning your monthly payments may fluctuate. HELOCs often have lower upfront closing costs than home equity loans.

-

Cash-Out Refinance: This involves refinancing your existing mortgage for a larger amount than your current loan balance. The difference between the new loan amount and your current loan balance is disbursed to you as cash. This can be a good option if you can secure a lower interest rate than your current mortgage, resulting in lower monthly payments and access to cash.

-

Reverse Mortgages: Designed for homeowners age 62 and older, a reverse mortgage allows you to convert your home equity into tax-free income. You don't make monthly mortgage payments; instead, the loan is repaid when you sell your home, move permanently, or pass away. It's crucial to understand the implications for your heirs and potential impact on your estate.

Closing Insights

Accessing home equity offers significant financial opportunities, but it's crucial to carefully weigh the pros and cons of each method. Consider your financial goals, credit score, and long-term plans before making a decision. Seeking professional financial advice is highly recommended to ensure you choose the option that best aligns with your individual circumstances. Understanding the implications of interest rates, closing costs, and repayment terms is essential for making a well-informed choice. Remember, responsible use of home equity can be a valuable asset, but mismanagement can lead to financial difficulties.

Exploring the Connection Between Credit Score and Accessing Home Equity

Your credit score plays a pivotal role in determining your eligibility for accessing home equity and the terms you'll receive. Lenders assess your creditworthiness to gauge the risk of lending you money secured by your home. A higher credit score generally results in more favorable terms, such as lower interest rates and more lenient loan requirements. Conversely, a lower credit score may lead to higher interest rates, stricter eligibility criteria, or even loan denial. Improving your credit score before applying for a home equity loan, HELOC, or cash-out refinance can significantly enhance your chances of securing favorable terms.

Further Analysis of Interest Rates and Repayment Terms

Interest rates are a critical factor influencing the overall cost of accessing home equity. Fixed-rate loans provide predictable monthly payments, while variable-rate loans offer the potential for lower initial payments but expose you to the risk of fluctuating interest rates. Understanding the repayment terms, including the loan term (length of the loan) and amortization schedule (how your payments are applied to principal and interest), is crucial for budgeting and financial planning. Comparing offers from multiple lenders and carefully reviewing the loan documents are essential steps to secure the best possible terms. Be sure to factor in closing costs and any additional fees when comparing options. A longer loan term results in lower monthly payments but higher overall interest paid, while a shorter loan term means higher monthly payments but lower total interest.

| Loan Type | Interest Rate Type | Typical Loan Term | Monthly Payment Impact | Total Interest Paid Impact |

|---|---|---|---|---|

| Home Equity Loan | Fixed | 10-30 years | Predictable | Higher for longer terms |

| HELOC | Variable | Draw period + repayment period | Fluctuating | Potentially higher |

| Cash-Out Refinance | Fixed or Variable | 15-30 years | Varies based on rate | Varies based on rate and term |

FAQ Section

Q1: What is the minimum credit score required to access home equity?

A1: While requirements vary by lender, a credit score of at least 620 is generally considered the minimum for most home equity loans and HELOCs. Cash-out refinances often require a higher credit score, typically above 660 or even 700.

Q2: How much equity do I need to access?

A2: Lenders typically require you to have at least 15-20% equity in your home. However, this can vary based on factors such as your credit score and the lender's policies.

Q3: What are the closing costs associated with accessing home equity?

A3: Closing costs can vary significantly depending on the loan type, lender, and your location. They typically include appraisal fees, title insurance, recording fees, and lender fees. Expect to pay several hundred to several thousand dollars in closing costs.

Q4: How long does it take to access home equity?

A4: The approval and funding process can take several weeks, depending on the lender and the complexity of your application. Be prepared for some delays.

Q5: Can I use home equity to pay off debt?

A5: Yes, you can consolidate high-interest debts such as credit card debt by using home equity. This can help lower your overall monthly payments and reduce your interest burden. However, make sure to consider the long-term implications.

Q6: What are the tax implications of accessing home equity?

A6: The interest paid on home equity loans and HELOCs may be tax-deductible under certain circumstances. Consult with a tax professional to determine your specific tax obligations.

Practical Tips for Accessing Home Equity Wisely

- Check your credit report: Review your credit report for any errors and work to improve your score before applying.

- Shop around for lenders: Compare interest rates, fees, and terms from multiple lenders to find the best deal.

- Understand your repayment options: Consider both fixed-rate and variable-rate options and choose the one that best fits your financial situation.

- Calculate your total cost: Don't just focus on monthly payments; calculate the total amount you'll pay over the life of the loan.

- Create a realistic budget: Ensure you can comfortably afford the monthly payments.

- Read the fine print: Carefully review all loan documents before signing.

- Seek professional advice: Consult a financial advisor to discuss your options and ensure you make an informed decision.

- Consider your long-term financial goals: Accessing home equity is a significant financial decision, so consider the long-term consequences.

Final Conclusion

Accessing home equity can be a powerful tool for achieving financial goals, but it requires careful consideration and planning. By understanding the different methods, carefully weighing the pros and cons, and following sound financial practices, you can leverage your home's equity responsibly and unlock valuable opportunities for financial growth. Remember, this is a significant decision, so always seek professional advice before proceeding. Careful planning and a clear understanding of the implications will help you navigate this process successfully and make the most of your home's value.

Latest Posts

Related Post

Thank you for visiting our website which covers about How To Access Home Equity . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.