How To Get More Student Loans

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Securing Student Loans: A Comprehensive Guide to Funding Your Education

How can students navigate the often-complex landscape of student loans to secure the funding they need for their education?

Successfully obtaining student loans requires a strategic approach, encompassing careful planning, diligent research, and a thorough understanding of the various loan options available.

Editor’s Note: This comprehensive guide to securing student loans was published today, providing readers with the most up-to-date information and strategies.

Why Securing Student Loans Matters

Higher education is increasingly vital for career advancement and economic mobility. However, the rising cost of tuition, fees, and living expenses often presents a significant financial barrier for many aspiring students. Student loans serve as a crucial bridge, enabling individuals to pursue their educational goals without the immediate burden of prohibitive costs. Understanding the intricacies of securing these loans is paramount to ensuring a smooth transition into higher education and a manageable repayment plan afterward. The implications extend beyond individual financial well-being; access to education empowers individuals to contribute more meaningfully to the economy and society as a whole. This impacts not only individual success but also national economic growth and social progress.

Overview of the Article

This article delves into the multifaceted world of student loans, providing a detailed roadmap for prospective students. It will explore various loan types, eligibility criteria, the application process, smart borrowing strategies, and crucial considerations for responsible loan management. Readers will gain actionable insights into maximizing their chances of loan approval and minimizing future financial strain.

Research and Effort Behind the Insights

This guide is the result of extensive research, drawing upon data from government sources like the Federal Student Aid website, industry reports from reputable financial institutions, and insights from financial aid experts. The information presented reflects current regulations and best practices in student loan acquisition.

Key Takeaways

| Key Aspect | Summary |

|---|---|

| Understanding Loan Types | Federal loans offer benefits like fixed interest rates and income-driven repayment plans; private loans often have higher rates. |

| Eligibility Requirements | Meeting specific academic and financial criteria is crucial for loan approval. |

| The Application Process | Completing the FAFSA and other necessary forms accurately and timely is essential. |

| Smart Borrowing Strategies | Borrowing only what's necessary and understanding repayment implications are vital. |

| Responsible Loan Management | Creating a repayment plan, budgeting effectively, and seeking help when needed are crucial for avoiding financial hardship. |

Let's delve deeper into the key aspects of securing student loans, beginning with the fundamental types of loans available.

Exploring the Key Aspects of Student Loan Acquisition

-

Federal vs. Private Loans: Federal student loans are offered by the U.S. government and generally offer more favorable terms than private loans, including fixed interest rates and various repayment options. Private loans are offered by banks and credit unions, and their terms vary significantly, often with higher interest rates and less flexible repayment options. Understanding the differences is crucial for making informed borrowing decisions.

-

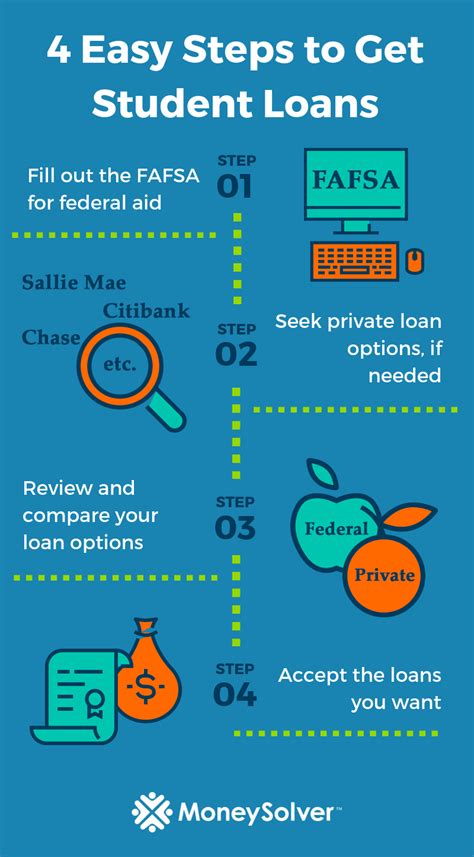

Eligibility and Application: Eligibility for federal student loans is determined by factors such as citizenship, enrollment status, and financial need (as determined by the Free Application for Federal Student Aid, or FAFSA). Private loan eligibility often depends on credit history, income, and co-signer availability. The application process involves completing the FAFSA for federal loans and separate applications for private loans.

-

Understanding Loan Terms and Repayment: Loan terms encompass the interest rate, loan amount, repayment period, and repayment plan. It's critical to carefully examine these terms before accepting any loan. Understanding the different repayment options available, such as standard, graduated, and income-driven repayment plans, is essential for planning long-term financial stability.

-

Managing Loan Debt: Responsible loan management involves creating a realistic repayment budget, monitoring loan statements regularly, and exploring options for loan consolidation or refinancing if necessary. Seeking financial counseling can be beneficial in navigating potential challenges and preventing default.

-

Exploring Alternative Funding Sources: In addition to loans, students should explore alternative funding sources like scholarships, grants, and work-study programs. These can significantly reduce the amount of money needed to be borrowed.

-

The Role of a Co-signer: For private loans, a co-signer – typically a parent or family member with good credit – may be required to increase the chances of approval. Understanding the co-signer's responsibilities and the potential impact on their credit score is critical.

Closing Insights

Securing student loans is a crucial step in accessing higher education, but it requires careful planning and responsible decision-making. By understanding the different loan types, eligibility criteria, and repayment options, students can make informed choices that align with their financial circumstances and long-term goals. Proactive management of loan debt is key to avoiding financial strain and ensuring a successful post-graduation transition. Remember to explore all available funding options, including grants and scholarships, to minimize reliance on loans.

Exploring the Connection Between Financial Literacy and Student Loan Success

Financial literacy plays a pivotal role in navigating the student loan process successfully. A strong understanding of budgeting, credit scores, interest rates, and loan repayment strategies empowers students to make informed decisions, minimizing the risk of accumulating excessive debt. Students with robust financial literacy are better equipped to compare loan offers, negotiate favorable terms, and create a sustainable repayment plan that prevents financial hardship post-graduation. Lack of financial literacy, conversely, can lead to poor borrowing decisions, increased debt burdens, and potential financial distress. Institutions should prioritize financial literacy education as part of the student support system.

Further Analysis of Financial Literacy

| Aspect of Financial Literacy | Impact on Student Loan Management | Example |

|---|---|---|

| Budgeting | Enables accurate estimation of expenses and loan needs, preventing overborrowing. | Creating a detailed budget to account for tuition, fees, living expenses, and loan repayments. |

| Credit Understanding | Facilitates informed comparison of loan offers and helps understand the impact of credit scores. | Comparing loan offers from different lenders based on interest rates and terms. |

| Interest Rate Knowledge | Allows for calculation of total repayment costs, minimizing the risk of unexpected expenses. | Understanding how interest compounds over time and the impact on total repayment. |

| Repayment Plan Strategies | Enables planning for manageable monthly payments, preventing default. | Choosing an income-driven repayment plan that aligns with post-graduation income projections. |

FAQ Section

-

Q: What is the FAFSA? A: The Free Application for Federal Student Aid (FAFSA) is a form used to determine eligibility for federal student aid, including grants, loans, and work-study.

-

Q: What is a co-signer? A: A co-signer is an individual who agrees to repay a loan if the primary borrower defaults. They typically have good credit.

-

Q: What are income-driven repayment plans? A: These plans tie monthly payments to a percentage of your income, making them more manageable for borrowers with lower post-graduation earnings.

-

Q: Can I refinance my student loans? A: Yes, refinancing can lower your interest rate or consolidate multiple loans into one. However, carefully weigh the pros and cons.

-

Q: What happens if I default on my student loans? A: Defaulting can lead to wage garnishment, tax refund offset, and damage to your credit score.

-

Q: Where can I get free financial aid advice? A: Your college's financial aid office, federal government websites (like studentaid.gov), and non-profit credit counseling agencies are excellent resources.

Practical Tips

-

Complete the FAFSA early: The sooner you apply, the better your chances of securing financial aid.

-

Compare loan offers carefully: Don't settle for the first offer you receive; shop around for the best terms.

-

Borrow only what you need: Avoid taking out more loans than necessary to cover your expenses.

-

Create a realistic repayment budget: Plan how you'll manage your loan payments after graduation.

-

Explore scholarships and grants: These can significantly reduce your borrowing needs.

-

Maintain good credit: A strong credit score can improve your chances of loan approval and securing favorable terms.

-

Seek financial aid counseling: A financial aid advisor can help you navigate the complex world of student loans.

-

Understand your repayment options: Choose a repayment plan that best fits your financial situation.

Final Conclusion

Securing student loans to fund higher education requires a proactive and informed approach. By understanding the different loan types, navigating the application process efficiently, and employing responsible borrowing and management strategies, students can effectively leverage student loans to pursue their educational aspirations while minimizing long-term financial risk. Remember that financial literacy is your strongest ally in this journey. With careful planning and informed decision-making, student loans can be a powerful tool for achieving academic success and building a brighter future. Continuous learning about financial management practices will be crucial for successfully managing loan debt and building a strong financial foundation for future endeavors.

Latest Posts

Related Post

Thank you for visiting our website which covers about How To Get More Student Loans . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.