What Are The Powers Of The Consumer Financial Protection Bureau

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Unlocking the Shield: The Extensive Powers of the Consumer Financial Protection Bureau (CFPB)

What makes the Consumer Financial Protection Bureau (CFPB) such a significant player in the financial landscape?

The CFPB wields substantial regulatory authority, safeguarding consumers from predatory practices and fostering a fairer financial marketplace.

Editor’s Note: This exploration of the CFPB's powers has been published today, offering an up-to-date analysis of its regulatory influence.

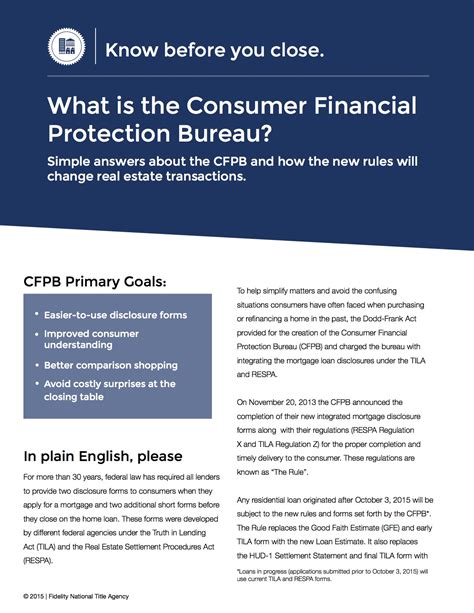

Why the CFPB Matters

The Consumer Financial Protection Bureau (CFPB) is a relatively young but immensely powerful independent agency of the United States government. Established in the wake of the 2008 financial crisis as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, its primary mission is to protect consumers from unfair, deceptive, or abusive practices in the financial marketplace. Its impact reaches far beyond individual consumers; the CFPB's actions significantly shape the landscape of financial services, influencing lending practices, credit reporting, debt collection, and more. The agency's existence reflects a growing recognition of the need for robust consumer protection in an increasingly complex and interconnected financial system. Its influence is felt by financial institutions of all sizes, from small community banks to multinational corporations. Failure to comply with CFPB regulations can lead to significant financial penalties and reputational damage, underscoring the agency's powerful role.

Overview of the Article

This article delves into the core powers of the CFPB, examining its rulemaking authority, enforcement capabilities, supervisory functions, and its impact on various sectors of the financial industry. Readers will gain a comprehensive understanding of the agency's influence and its critical role in protecting consumers' financial well-being. We'll explore its historical context, its various enforcement tools, and future challenges facing the CFPB in maintaining a fair and transparent financial system.

Research and Effort Behind the Insights

This article draws upon extensive research, including analysis of the Dodd-Frank Act, CFPB rulemakings, enforcement actions, court decisions, and academic literature on consumer finance. The insights presented are based on a thorough examination of the CFPB’s official publications, legal precedents, and expert commentary.

Key Takeaways:

| Key Area | Key Insight |

|---|---|

| Rulemaking Authority | The CFPB has broad authority to issue regulations impacting a wide range of financial products and services. |

| Enforcement Powers | The CFPB possesses strong enforcement tools, including the ability to impose significant fines and penalties. |

| Supervisory Oversight | The CFPB directly supervises large financial institutions, ensuring compliance with consumer protection laws. |

| Consumer Complaint Database | The CFPB maintains a public database of consumer complaints, providing valuable insights into industry trends. |

| Restitution and Redress | The CFPB can order restitution to consumers harmed by unfair or deceptive practices. |

Smooth Transition to Core Discussion

Let's now explore the multifaceted powers of the CFPB, starting with its foundation in the Dodd-Frank Act and moving to its key operational mechanisms.

Exploring the Key Aspects of CFPB Powers

-

Rulemaking: The CFPB possesses significant rulemaking authority. It can issue regulations covering various aspects of consumer financial products and services, including mortgages, credit cards, payday loans, debt collection, and prepaid cards. These regulations often set standards for transparency, fairness, and responsible lending practices. The agency's rulemaking process involves public notice and comment periods, ensuring that affected parties have an opportunity to express their views.

-

Enforcement: The CFPB has robust enforcement powers to investigate and prosecute violations of consumer financial protection laws. These powers extend to civil penalties, restitution for harmed consumers, and injunctive relief to prevent future misconduct. The agency can investigate individual complaints or launch broader systemic investigations into industry practices. Enforcement actions can involve significant financial penalties, impacting the profitability and reputation of offending institutions.

-

Supervision: The CFPB directly supervises large banks and other financial institutions to assess their compliance with consumer protection laws. This supervisory authority allows the agency to identify and address potential risks before they escalate into widespread consumer harm. Supervisory examinations often involve reviews of internal controls, lending practices, and customer service procedures.

-

Consumer Complaint Database: One of the CFPB's notable contributions is its public database of consumer complaints. This database allows consumers to easily file complaints and tracks complaints filed by other consumers. This provides valuable data for identifying trends, emerging issues, and areas where additional regulatory attention may be needed. The data helps the CFPB prioritize its enforcement and supervisory activities.

-

Education and Outreach: Beyond enforcement and supervision, the CFPB actively engages in consumer education and outreach efforts. It provides resources and tools to help consumers understand their rights, avoid predatory practices, and make informed financial decisions. This educational component is crucial in empowering consumers to navigate the complexities of the financial marketplace.

Closing Insights

The CFPB’s powers are designed to create a more equitable and transparent financial system. Its rulemaking, enforcement, and supervisory functions work in concert to protect consumers from abusive lending practices and ensure fair treatment in financial transactions. The success of the CFPB in fulfilling its mandate depends not only on its regulatory tools but also on its ability to adapt to the constantly evolving financial landscape.

Exploring the Connection Between Data Analytics and the CFPB

The CFPB's effectiveness is significantly enhanced by its use of data analytics. The agency collects vast amounts of data from various sources, including its consumer complaint database, supervisory examinations, and industry reports. Advanced data analytics techniques allow the CFPB to identify patterns of misconduct, predict potential risks, and target its enforcement and supervisory resources effectively. For instance, by analyzing complaint data, the CFPB can identify emerging trends in predatory lending or debt collection practices, allowing for proactive interventions. This data-driven approach enhances the agency's efficiency and allows for more targeted and impactful regulatory oversight.

Further Analysis of Data Analytics

Data analytics plays a crucial role in the CFPB's ability to:

- Identify systemic risks: Analyze large datasets to pinpoint widespread problems in the financial industry.

- Target enforcement efforts: Prioritize investigations based on data-driven risk assessments.

- Measure the impact of regulations: Evaluate the effectiveness of new rules and adjust them as needed.

- Improve consumer education: Use data to understand consumer needs and develop more effective educational materials.

The CFPB uses sophisticated statistical modeling and machine learning algorithms to uncover hidden patterns and relationships within its datasets. This allows for predictive modeling, enabling the agency to anticipate potential consumer harm and take preventative measures.

| Data Source | Application in CFPB Operations |

|---|---|

| Consumer Complaint Database | Identifying trends in predatory lending, debt collection, etc. |

| Supervisory Examination Data | Assessing the effectiveness of risk management practices at financial institutions |

| Industry Reports | Tracking industry-wide trends and identifying potential vulnerabilities |

FAQ Section

-

Q: What happens if a financial institution violates CFPB rules? A: The CFPB can impose significant fines, order restitution to harmed consumers, and take other enforcement actions, potentially including legal action.

-

Q: Can I file a complaint with the CFPB? A: Yes, consumers can easily file complaints through the CFPB's website.

-

Q: Does the CFPB regulate all financial institutions? A: The CFPB primarily regulates larger financial institutions. Smaller institutions may be regulated by state agencies.

-

Q: Is the CFPB effective? A: The CFPB's effectiveness is a subject of ongoing debate, with some arguing it has been too aggressive while others see it as a crucial protector of consumers. Its impact is undeniable, however.

-

Q: How does the CFPB protect my data? A: The CFPB is subject to various privacy regulations and takes steps to protect consumer data.

-

Q: What types of financial products does the CFPB regulate? A: The CFPB regulates a wide range of financial products, including mortgages, credit cards, payday loans, student loans, debt collection, and more.

Practical Tips

- Understand your rights: Familiarize yourself with your consumer rights under federal law.

- Shop around for financial products: Compare offers from different providers to get the best terms.

- Read the fine print: Carefully review all contracts and disclosures before signing.

- Monitor your credit reports: Regularly check your credit reports for errors or signs of fraud.

- Report suspicious activity: Immediately report any suspected fraud or identity theft to the appropriate authorities.

- Save all your documentation: Keep records of all financial transactions and communications.

- Consider seeking legal advice: If you encounter problems with a financial institution, seek help from a qualified attorney.

- File a complaint with the CFPB: If you believe you've been wronged by a financial institution, file a complaint with the CFPB.

Final Conclusion

The CFPB's powers are integral to maintaining a fair and stable financial system. Its multifaceted approach, combining rulemaking, enforcement, and supervision, creates a strong framework for protecting consumers from abusive practices. While the agency's impact and methods remain subjects of debate, its role in safeguarding consumer interests in the complex world of finance is undeniable. The future of the CFPB will likely involve continued adaptation to evolving technologies and financial innovations while striving to maintain its core mission of consumer protection. Understanding the agency’s powers empowers consumers to navigate the financial marketplace more confidently and effectively.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Are The Powers Of The Consumer Financial Protection Bureau . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.