What Is Charge Card Vs Credit Card

adminse

Mar 28, 2025 · 9 min read

Table of Contents

Charge Card vs. Credit Card: Unveiling the Key Differences

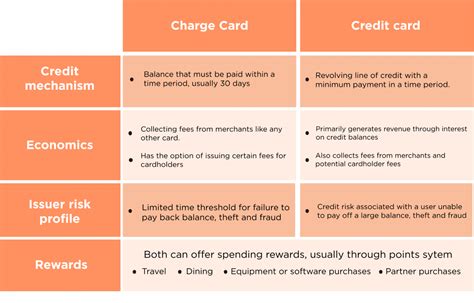

What's the real difference between a charge card and a credit card? Many people use the terms interchangeably, but there's a crucial distinction that can significantly impact your finances.

Understanding the nuances between charge cards and credit cards is paramount for making informed financial decisions and optimizing your spending strategies.

Editor’s Note: This comprehensive guide to charge cards vs. credit cards has been published today.

Why Understanding Charge Cards vs. Credit Cards Matters

In today's consumer landscape, navigating the complexities of payment options is crucial. While both charge cards and credit cards allow you to make purchases without using cash, their fundamental structures and operational mechanisms differ significantly. Choosing the right card depends heavily on your spending habits, financial discipline, and overall financial goals. Understanding these differences can prevent unexpected fees, improve your credit score, and ultimately contribute to better financial health. This knowledge is relevant for individuals, businesses, and anyone seeking to optimize their payment methods.

Overview of the Article

This article will explore the core distinctions between charge cards and credit cards, examining their fee structures, repayment terms, credit reporting implications, and suitability for different financial profiles. Readers will gain a clear understanding of the advantages and disadvantages of each, empowering them to make informed decisions regarding their payment card choices. We’ll delve into real-world examples and practical applications to illustrate the practical impact of these differences.

Research and Effort Behind the Insights

This article is based on extensive research, incorporating information from reputable financial institutions, consumer protection agencies, and industry experts. We have analyzed various cardholder agreements, fee schedules, and credit reporting practices to ensure the accuracy and completeness of the presented information.

Key Differences: Charge Card vs. Credit Card

| Feature | Charge Card | Credit Card |

|---|---|---|

| Repayment | Full balance due monthly | Minimum payment or full balance |

| Interest Charges | Typically None | Interest charged on outstanding balances |

| Credit Limit | Usually High, but pre-approved | Pre-set credit limit |

| Credit Score Impact | Minimal to none (if used responsibly) | Significant impact (positive or negative) |

| Annual Fee | Often High | Varies widely, from none to substantial |

| Rewards Programs | Often robust and generous | Varies widely, from basic to highly rewarding |

| Acceptance | May have limited acceptance than credit cards | Widely accepted worldwide |

Smooth Transition to Core Discussion

Let's now delve deeper into the key aspects distinguishing charge cards from credit cards, examining their operational mechanics and the financial implications for cardholders.

Exploring the Key Aspects of Charge Cards vs. Credit Cards

-

Payment Terms & Interest: The most fundamental difference lies in repayment. Charge cards require you to pay your balance in full each month. Failure to do so results in penalties, late fees, and potential account suspension. Credit cards, on the other hand, allow you to pay a minimum amount each month, carrying forward the remaining balance and accruing interest charges on the outstanding amount.

-

Credit Limits & Spending Power: Charge cards typically have high spending limits, often pre-approved based on your financial history. This allows for significant purchasing power, particularly beneficial for businesses or frequent travelers. Credit cards have pre-set credit limits, reflecting your creditworthiness. Exceeding this limit results in penalties and declined transactions.

-

Impact on Credit Score: While responsible use of either card positively impacts your credit score (through on-time payments and low credit utilization), the impact differs. Charge cards typically don't report to credit bureaus unless payments are missed. Credit cards report your payment activity, credit utilization, and account age, significantly influencing your credit score. A missed payment on a credit card has a more severe impact than on a charge card.

-

Fees and Rewards: Charge cards often come with substantial annual fees, offset by superior rewards programs and travel benefits. These benefits can outweigh the annual cost for high-spending individuals. Credit cards have varied fee structures, some offering no annual fees but with less generous rewards programs.

-

Acceptance and Usage: Credit cards enjoy wider acceptance worldwide compared to charge cards. While many businesses accept major charge cards like American Express, the acceptance rate isn't as ubiquitous as that of credit cards such as Visa and Mastercard.

-

Application Process: The application process for charge cards is often more rigorous and requires a stronger financial profile due to the higher spending limits and associated risk. Credit card applications have varying levels of stringency depending on the card and issuer.

Closing Insights

The choice between a charge card and a credit card depends entirely on individual circumstances and financial discipline. Charge cards are ideal for responsible spenders who can consistently pay their balances in full each month and value premium rewards and benefits. Credit cards offer greater flexibility for managing expenses but require responsible budgeting and awareness of interest charges. The key takeaway is understanding your financial habits and selecting the card that aligns with them.

Exploring the Connection Between Financial Literacy and Charge Card/Credit Card Usage

Financial literacy plays a crucial role in effectively managing both charge cards and credit cards. A lack of understanding can lead to overspending, accumulating debt, and damaging credit scores. Individuals with strong financial literacy skills are better equipped to leverage the benefits of these cards while mitigating the potential risks. For example, understanding interest calculations, credit utilization ratios, and the impact of missed payments enables informed decision-making.

Roles and Real-World Examples: Consider a small business owner using a charge card for business expenses. The higher credit limit allows them to manage large purchases, and the rewards program can offer substantial benefits. However, a lack of financial literacy could lead to overspending and difficulty managing the full monthly balance, resulting in penalties. Conversely, an individual with excellent financial literacy could use a credit card to build their credit history responsibly by consistently paying their balance in full and maintaining low credit utilization.

Risks and Mitigations: The primary risk associated with charge cards is the potential for high annual fees if balances aren't managed effectively. The risk with credit cards is accumulating high-interest debt due to unpaid balances. Mitigating these risks involves careful budgeting, setting spending limits, and consistently monitoring account activity.

Impact and Implications: The impact of responsible use of charge cards and credit cards on an individual's financial well-being can be significant. Building positive credit history, earning rewards, and accessing convenient payment options are all potential benefits. However, irresponsible usage can result in debt accumulation, damaged credit scores, and financial hardship.

Further Analysis of Financial Literacy

Financial literacy encompasses a range of knowledge and skills related to managing personal finances effectively. This includes budgeting, saving, investing, understanding credit scores, and debt management.

Cause-and-Effect Relationships: Lack of financial literacy can directly lead to poor financial decisions, resulting in debt, low credit scores, and financial instability. Conversely, strong financial literacy empowers individuals to make informed choices, achieve financial goals, and build financial security.

Significance and Applications: The significance of financial literacy extends beyond personal finances. It impacts economic stability, business success, and overall societal well-being. Effective financial literacy programs are crucial for empowering individuals to manage their finances responsibly and contribute to a stronger economy.

| Aspect of Financial Literacy | Significance | Application |

|---|---|---|

| Budgeting | Controls spending, prevents overspending | Creating a monthly budget, tracking expenses |

| Saving | Builds financial security, funds future goals | Establishing savings plans, setting savings goals |

| Investing | Grows wealth, achieves long-term financial goals | Researching investment options, diversifying assets |

| Credit Management | Builds credit scores, accesses credit easily | Monitoring credit reports, managing credit utilization |

| Debt Management | Prevents financial hardship, avoids debt traps | Developing a debt repayment plan, seeking debt counselling |

FAQ Section

Q1: Can I use a charge card for online purchases?

A1: Most major charge cards are accepted by online retailers, but acceptance may vary depending on the specific merchant and card issuer.

Q2: What happens if I don't pay my charge card balance in full?

A2: You will likely incur late fees and potentially have your account suspended. Continuing to miss payments could negatively impact your credit score, although charge cards don’t typically report to credit bureaus unless payments are consistently missed.

Q3: Are charge cards better than credit cards?

A3: Neither is inherently "better." The best choice depends on your financial habits and spending patterns. Charge cards suit disciplined spenders who pay their balances in full, while credit cards provide more flexibility but require responsible management.

Q4: Do charge cards build credit?

A4: Generally, no. Charge card activity is not typically reported to the credit bureaus unless you repeatedly fail to pay your balance in full.

Q5: What are the benefits of a credit card?

A5: Credit cards offer flexibility in repayment, build credit history (when used responsibly), and offer various rewards programs.

Q6: What are the drawbacks of a charge card?

A6: The significant annual fees and the requirement to pay the balance in full each month can be drawbacks for some individuals.

Practical Tips for Managing Charge Cards and Credit Cards

- Create a Budget: Track your income and expenses to understand your spending habits.

- Set Spending Limits: Determine how much you can comfortably spend each month on your cards.

- Pay Bills on Time: Always pay your minimum payment due or full balance by the due date.

- Monitor Account Activity: Regularly review your statements to identify any unauthorized charges.

- Maintain Low Credit Utilization: Keep your credit utilization ratio (the amount of credit you use compared to your available credit) low to improve your credit score (for credit cards only).

- Read the Fine Print: Carefully review the terms and conditions of your cardholder agreement before signing up.

- Choose Cards Wisely: Select cards that align with your spending habits and financial goals.

- Consider Rewards Programs: If you spend a lot, choose cards with rewarding benefits.

Final Conclusion

The choice between a charge card and a credit card represents a crucial financial decision. Understanding the inherent differences in repayment terms, fees, and credit reporting implications is crucial for making an informed choice aligned with individual financial circumstances and goals. Responsible usage of either card type is paramount in maintaining financial health and building a positive credit history. Continued learning and development of financial literacy are essential to leverage the benefits of these payment options while mitigating potential risks. Ultimately, informed decision-making is key to successfully navigating the world of credit and charge cards.

Latest Posts

Latest Posts

-

New Indications Definition

Apr 01, 2025

-

New Home Sales Definition

Apr 01, 2025

-

What Is New Growth Theory Definition How Its Used And Example

Apr 01, 2025

-

New Fund Offer Nfo Definition Types Launches And Benefits

Apr 01, 2025

-

New Economy Definition History Examples Of Companies

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about What Is Charge Card Vs Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.