What Is Quantitative Trading Definition Examples And Profit

adminse

Mar 31, 2025 · 7 min read

Table of Contents

Decoding Quantitative Trading: Definition, Examples, and Profit Potential

What sets quantitative trading apart in the complex world of finance?

Quantitative trading (quant trading) is revolutionizing financial markets, offering unprecedented opportunities for profit and efficiency.

Editor’s Note: This comprehensive guide to quantitative trading has been published today, offering up-to-date insights into this dynamic field.

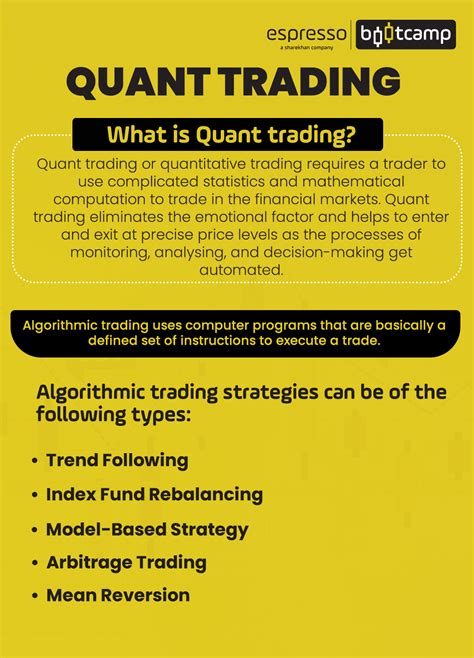

Why Quantitative Trading Matters

Quantitative trading, or quant trading, leverages advanced mathematical and statistical models to identify and exploit trading opportunities. Unlike traditional discretionary trading, which relies on human judgment and intuition, quant trading employs algorithms and data-driven analysis to execute trades automatically. This approach offers several key advantages: speed, objectivity, and the ability to process vast quantities of data that would be impossible for a human trader. Its impact resonates across various financial markets, from equities and futures to options and forex, transforming how investments are managed and profits are generated. The rise of big data, coupled with increasingly powerful computing capabilities, has fueled the growth and sophistication of quantitative trading strategies. This makes understanding quant trading essential for anyone seeking to navigate the modern financial landscape.

Overview of the Article

This article delves into the core principles of quantitative trading, exploring its definition, diverse strategies, the crucial role of data analysis, risk management considerations, and the potential for profit. Readers will gain a comprehensive understanding of this rapidly evolving field, acquiring valuable insights into its methodologies, applications, and future prospects. We will also analyze specific examples and discuss the crucial role of technology in its success.

Research and Effort Behind the Insights

The insights presented here are based on extensive research, incorporating data from reputable financial sources, peer-reviewed academic studies, and analyses of publicly available information on successful quantitative trading firms.

Key Takeaways

| Key Aspect | Description |

|---|---|

| Definition of Quant Trading | Utilizing mathematical models and algorithms for automated trading decisions. |

| Data-Driven Approach | Relies heavily on historical data, market indicators, and alternative data sources for strategy development and execution. |

| Algorithmic Trading | Employs computer programs to execute trades based on pre-defined rules and parameters. |

| Risk Management | Critical component involving backtesting, stress testing, and position sizing to mitigate potential losses. |

| Profit Generation | Potential for significant returns through efficient execution, systematic risk management, and exploitation of market inefficiencies. |

| Technological Dependence | Heavily reliant on advanced computing power, high-frequency data feeds, and sophisticated software infrastructure. |

Smooth Transition to Core Discussion

Let's now delve into the core components of quantitative trading, examining its fundamental principles, methodologies, and the factors contributing to its success.

Exploring the Key Aspects of Quantitative Trading

-

Algorithmic Strategies: Quant trading relies heavily on algorithms that define precise rules for entering and exiting trades. These algorithms can range from simple moving average crossovers to complex machine learning models. The choice of algorithm depends on the specific trading strategy and market conditions.

-

Data Analysis and Backtesting: The cornerstone of successful quant trading is robust data analysis. Historical market data, economic indicators, news sentiment, and even alternative data sources are analyzed to identify patterns and predictive signals. Backtesting, the process of simulating a trading strategy on historical data, is critical for evaluating its effectiveness and identifying potential weaknesses before deploying it in live markets.

-

Risk Management and Optimization: Effective risk management is paramount. Quant traders employ various techniques, including position sizing, stop-loss orders, and diversification, to control risk and protect capital. Continuous optimization of trading strategies is essential to adapt to changing market dynamics and improve profitability.

-

Technology and Infrastructure: The technological infrastructure supporting quant trading is sophisticated and demanding. High-frequency data feeds, powerful computing hardware, and specialized software are necessary for executing trades swiftly and efficiently. This infrastructure requires significant investment and expertise to maintain.

-

Regulatory Compliance: Quant trading firms must comply with stringent regulations designed to ensure market integrity and protect investors. This includes reporting requirements, anti-money laundering (AML) measures, and adherence to specific trading rules.

Closing Insights

Quantitative trading is not merely a trend but a fundamental shift in how financial markets operate. Its ability to process vast datasets, identify subtle patterns, and execute trades with speed and precision has fundamentally altered the competitive landscape. While it presents significant opportunities for profit, success requires a deep understanding of mathematical modeling, statistical analysis, risk management, and cutting-edge technology. The future of quant trading likely involves even greater integration of artificial intelligence and machine learning, further enhancing its efficiency and predictive capabilities.

Exploring the Connection Between Risk Management and Quantitative Trading

Risk management is inextricably linked to successful quantitative trading. Because quant strategies often involve high-frequency trading and leverage, the potential for both significant profits and substantial losses is substantial. Robust risk management techniques are not optional; they are essential for survival. These include:

-

Backtesting and Simulation: Rigorous backtesting on extensive historical data allows traders to assess the performance of their strategies under various market conditions. Simulations help identify vulnerabilities and optimize parameters before live deployment.

-

Stress Testing: Stress testing exposes the strategy to extreme market events (e.g., crashes, flash crashes) to evaluate its resilience and potential losses under adverse scenarios.

-

Position Sizing: Careful position sizing dictates the amount of capital allocated to each trade, limiting potential losses to a manageable level even if the trade is unsuccessful.

-

Stop-Loss Orders: Stop-loss orders automatically exit a trade when the price reaches a predetermined level, limiting potential losses.

-

Diversification: Diversifying across multiple assets or strategies reduces the overall portfolio risk by preventing a single unfavorable event from significantly impacting the entire portfolio.

Further Analysis of Risk Management

| Risk Type | Mitigation Strategy | Example |

|---|---|---|

| Market Risk | Diversification, Stop-loss orders, hedging | Investing in diverse asset classes, setting stop-loss orders at 5% below entry price. |

| Model Risk | Backtesting, stress testing, continuous monitoring | Regularly evaluating the model's performance and making adjustments as needed. |

| Operational Risk | Redundant systems, robust infrastructure, cybersecurity | Having backup systems to prevent outages and data breaches. |

| Liquidity Risk | Maintaining sufficient cash reserves, using liquid assets | Ensuring enough cash to cover potential margin calls or unexpected losses. |

FAQ Section

-

Q: What is the minimum capital required to start quant trading? A: There's no fixed minimum, but significant capital is usually needed due to the complexity and technology involved. Professional quant firms often operate with millions or even billions of dollars.

-

Q: What programming languages are commonly used in quant trading? A: Python, R, C++, and Java are widely used. Python is particularly popular for its extensive libraries and ease of use.

-

Q: Is quant trading suitable for beginners? A: No, it requires advanced knowledge of mathematics, statistics, programming, and finance. It's best suited for individuals with a strong quantitative background.

-

Q: What are the potential drawbacks of quant trading? A: Over-optimization, unexpected market events, and technological failures are all potential drawbacks.

-

Q: How can I learn more about quantitative trading? A: Numerous online courses, books, and academic resources are available. Networking with professionals in the field is also beneficial.

-

Q: Is high-frequency trading a type of quantitative trading? A: Yes, high-frequency trading (HFT) is a specialized subset of quantitative trading that uses extremely fast algorithms to exploit tiny price discrepancies.

Practical Tips

- Develop a Strong Quantitative Foundation: Master mathematics, statistics, and programming.

- Learn a Relevant Programming Language: Focus on Python or R for data analysis and algorithm development.

- Gain Experience with Data Analysis Tools: Familiarize yourself with tools like Pandas, NumPy, and Scikit-learn.

- Study Algorithmic Trading Strategies: Research various strategies, including mean reversion, momentum trading, and arbitrage.

- Practice Backtesting and Optimization: Develop and test strategies rigorously using historical data.

- Implement Risk Management Techniques: Incorporate stop-losses, position sizing, and diversification into your strategies.

- Stay Updated on Market Trends: Keep abreast of evolving market dynamics and technological advancements.

- Network with Professionals: Connect with experienced quant traders to learn from their insights and expertise.

Final Conclusion

Quantitative trading presents both extraordinary opportunities and substantial challenges. Its reliance on advanced technology, sophisticated algorithms, and rigorous risk management creates a dynamic and ever-evolving landscape. While success in quant trading necessitates a significant investment in expertise and resources, the potential rewards for those who master its intricacies are substantial. This guide provides a fundamental framework for understanding this field, but continued learning and adaptation are crucial for long-term success. The future of finance increasingly hinges on the ability to harness the power of data and algorithms, solidifying quantitative trading's position as a core element of modern financial markets.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is Quantitative Trading Definition Examples And Profit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.