What Matters To Millennials When It Comes To Money Management

adminse

Mar 28, 2025 · 7 min read

Table of Contents

What Matters to Millennials When It Comes to Money Management: A Deep Dive into Financial Priorities and Behaviors

What sets millennial money management apart from previous generations?

Millennials are redefining financial success, prioritizing experiences and values over traditional wealth accumulation.

Editor’s Note: This article on millennial money management was published today, offering the latest insights into this dynamic demographic's financial priorities and behaviors.

Why Millennial Money Management Matters

Understanding how millennials approach money is crucial for several reasons. This generation represents a significant portion of the global workforce and consumer base. Their financial decisions influence market trends, investment strategies, and the overall economic landscape. Businesses, financial institutions, and policymakers need to adapt to their unique priorities and preferences to effectively engage and serve them. Furthermore, studying millennial financial behaviors provides valuable insights into broader societal shifts in values and priorities.

Overview of the Article

This article delves into the multifaceted world of millennial money management, exploring their core values, financial anxieties, and unique approaches to saving, investing, and spending. We will examine the influence of technology, societal changes, and economic realities on their financial decisions. Readers will gain a comprehensive understanding of this generation's financial landscape and actionable strategies for effective financial planning.

Research and Effort Behind the Insights

The insights presented in this article are based on a comprehensive review of peer-reviewed academic research, industry reports from reputable sources like the Federal Reserve and Nielsen, and data from leading financial technology companies. We have also considered survey data and anecdotal evidence to provide a well-rounded perspective on millennial financial behaviors.

Key Takeaways

| Key Aspect | Insight |

|---|---|

| Experiences over Possessions | Millennials prioritize experiences and personal growth over material wealth accumulation. |

| Financial Anxiety | High levels of student loan debt and economic uncertainty contribute to significant financial stress. |

| Technology Adoption | Fintech apps and digital tools play a significant role in managing finances. |

| Social Responsibility | ESG (Environmental, Social, and Governance) investing is gaining traction amongst millennials. |

| Flexibility and Control | Millennials value financial flexibility and control over their money. |

| Long-Term Planning | While debt may be a concern, many are focusing on long-term financial security. |

Smooth Transition to Core Discussion

Let's now explore the key aspects of millennial money management, examining their values, challenges, and innovative approaches to financial planning.

Exploring the Key Aspects of Millennial Money Management

-

Experiential Spending: Millennials often prioritize experiences over material possessions. Travel, concerts, and unique activities hold more value than accumulating physical assets. This shift reflects a change in societal values, emphasizing personal growth and creating lasting memories. This isn't to say they avoid saving, but their spending patterns reflect a different prioritization.

-

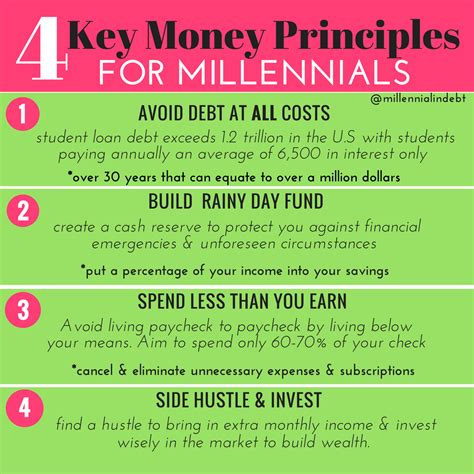

The Weight of Debt: High levels of student loan debt significantly impact millennial financial planning. This debt burden often delays major life milestones like homeownership and starting a family. The pressure to repay loans consumes a substantial portion of their income, limiting their ability to save and invest aggressively. This also contributes to higher levels of financial anxiety.

-

Technological Dependence: Millennials are highly tech-savvy, relying heavily on financial technology (fintech) apps and digital tools for banking, investing, and budgeting. These tools offer convenience, transparency, and personalized financial management features. The rise of robo-advisors and budgeting apps reflects this preference for streamlined, tech-driven financial solutions.

-

Socially Responsible Investing (SRI): Growing awareness of social and environmental issues influences millennial investment choices. Many are drawn to ESG (Environmental, Social, and Governance) investing, seeking companies aligned with their values. This reflects a desire to invest in businesses that contribute positively to society and the environment.

-

Financial Flexibility and Control: Millennials desire control over their finances and flexibility in their spending. They value financial products and services that offer personalized options, transparency, and the ability to adjust their financial plans as needed. This desire for flexibility often translates to a preference for diversified investment strategies and adaptable financial plans.

-

Long-Term Financial Planning (Despite Challenges): While burdened by debt, many millennials are still focused on long-term financial goals. They are increasingly seeking advice and resources to navigate financial complexities and build a secure financial future. This demonstrates a commitment to financial security, even in the face of significant challenges.

Closing Insights

Millennial money management represents a significant departure from previous generations. Their focus on experiences, use of technology, and consideration of social responsibility reshape the financial landscape. While challenges such as student loan debt and economic uncertainty exist, many are proactively planning for the future, demonstrating a commitment to financial security and aligning their investments with their values. This generation's impact on financial markets and societal values will continue to evolve in the coming years.

Exploring the Connection Between Financial Anxiety and Millennial Money Management

High levels of financial anxiety are prevalent amongst millennials. This anxiety is fueled by several factors, including student loan debt, stagnant wages, rising living costs, and economic uncertainty. The constant pressure to manage debt, save for the future, and navigate unpredictable economic conditions contributes to significant stress and impacts their overall well-being.

This anxiety directly influences their financial decisions. It can lead to impulsive spending to cope with stress, reluctance to invest due to fear of loss, and difficulty in making long-term financial plans. Many millennials delay major life decisions due to financial anxiety, postponing homeownership, marriage, or starting a family until they feel more financially secure.

Further Analysis of Financial Anxiety

| Contributing Factor | Impact on Financial Behavior | Mitigation Strategies |

|---|---|---|

| Student Loan Debt | Delays major life milestones, limits saving and investing, increases financial stress. | Debt consolidation, budgeting, financial counseling. |

| Stagnant Wages | Reduces savings potential, increases financial pressure. | Seeking higher-paying jobs, improving skills, negotiating salary increases. |

| Rising Living Costs | Limits disposable income, increases financial strain. | Budgeting, cost-cutting measures, exploring cheaper living options. |

| Economic Uncertainty | Creates fear of loss, hinders investment decisions. | Diversification, long-term investment strategies, financial planning with professional advice. |

| Lack of Financial Literacy | Impacts ability to make informed financial decisions. | Seeking financial education, utilizing online resources, attending workshops. |

FAQ Section

-

Q: How can millennials overcome financial anxiety? A: Seek professional financial advice, create a realistic budget, track spending, and educate themselves about personal finance.

-

Q: What are the best investment strategies for millennials? A: Diversify investments across different asset classes, consider index funds or ETFs, and explore robo-advisors.

-

Q: How can millennials reduce student loan debt? A: Explore income-driven repayment plans, consider refinancing options, and prioritize extra payments.

-

Q: What role does technology play in millennial finance? A: Technology streamlines financial management, offers access to personalized tools, and improves financial literacy.

-

Q: How can millennials prioritize experiences without overspending? A: Create a budget that allocates funds for experiences, plan in advance, and seek affordable options.

-

Q: What is the importance of long-term financial planning for millennials? A: Long-term planning ensures financial security for retirement, major life events, and unexpected circumstances.

Practical Tips

-

Create a Detailed Budget: Track income and expenses to understand spending habits and identify areas for savings.

-

Automate Savings: Set up automatic transfers to savings and investment accounts to build wealth consistently.

-

Pay Down High-Interest Debt: Prioritize paying down high-interest debt like credit card balances to reduce overall interest payments.

-

Explore Retirement Savings Options: Contribute to employer-sponsored retirement plans (like 401(k)s) and individual retirement accounts (IRAs) to maximize tax benefits and build long-term wealth.

-

Build an Emergency Fund: Establish a savings account with 3-6 months of living expenses to cover unexpected costs.

-

Seek Professional Financial Advice: Consult with a financial advisor to receive personalized guidance and develop a tailored financial plan.

-

Enhance Financial Literacy: Continuously improve financial knowledge through books, online resources, and workshops.

-

Review and Adjust Your Plan Regularly: Regularly review your budget, investment portfolio, and financial goals to adapt to changing circumstances.

Final Conclusion

Millennial money management is characterized by a unique blend of challenges and innovative approaches. While student loan debt and economic uncertainty present significant hurdles, this generation’s emphasis on experiences, technological adoption, and social responsibility are reshaping the financial landscape. By understanding their priorities, values, and financial anxieties, financial institutions, businesses, and policymakers can better serve their needs and foster a more inclusive and equitable financial system. The continued evolution of millennial financial behaviors will undoubtedly continue to influence the future of finance. Further research and engagement are crucial to understand and respond to the dynamic priorities of this influential generation.

Latest Posts

Latest Posts

-

Who Does Penn Credit Collect For

Mar 31, 2025

-

What Can You Use Carnival Onboard Credit For

Mar 31, 2025

-

What Credit Bureau Does T Mobile Use

Mar 31, 2025

-

Putable Common Stock Definition

Mar 31, 2025

-

Put Call Parity Definition Formula How It Works And Examples

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about What Matters To Millennials When It Comes To Money Management . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.