Why Are The Two Options Contracts With The Same Exercise Price Of The Same Issuer Priced Differently

adminse

Mar 28, 2025 · 9 min read

Table of Contents

Why Are Two Option Contracts with the Same Exercise Price and Issuer Priced Differently? Unraveling the Mysteries of Option Pricing

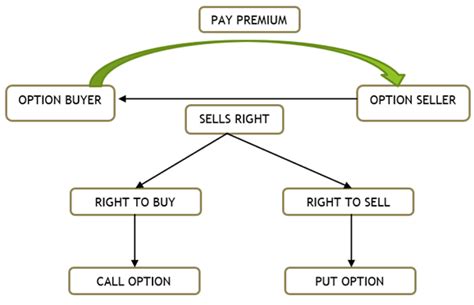

Why do two seemingly identical options contracts, issued by the same company and carrying the same exercise price, trade at different prices? This isn't a glitch; it's a key aspect of options pricing that reveals much about market dynamics.

Option pricing is a complex dance of probabilities, time decay, and market sentiment, resulting in subtle yet significant price variations even among contracts with identical core features.

Editor’s Note: Understanding the nuances of options pricing is crucial for both novice and experienced traders. This article, published today, delves into the factors contributing to price discrepancies among options contracts with the same strike price and underlying asset.

Why Option Price Differences Matter

Understanding why option contracts with identical strike prices and underlying issuers trade at different prices is paramount for effective options trading strategies. Ignoring these differences can lead to missed opportunities or, worse, substantial losses. This knowledge empowers traders to identify mispriced options and capitalize on market inefficiencies. The ability to discern these price variations also allows for a more nuanced understanding of market sentiment and the risk-reward profile of different options positions. This is crucial for hedging, speculation, and income generation strategies.

Overview of This Article

This article explores the key factors contributing to the price discrepancies between options contracts with identical strike prices and underlying assets. We will investigate the roles of time to expiration, implied volatility, interest rates, and dividends, illustrating their effects with real-world examples and clarifying their influence on option pricing models. Readers will gain a deeper understanding of the complexities involved in options pricing and develop a more informed approach to option trading.

Research and Effort Behind the Insights

This article draws upon extensive research, including analysis of market data, theoretical option pricing models like the Black-Scholes model, and insights from leading financial academics and practitioners. The information presented is based on established financial principles and aims to provide a clear, accurate, and actionable understanding of option pricing dynamics.

Key Takeaways

| Factor | Impact on Option Price Difference | Explanation |

|---|---|---|

| Time to Expiration | Shorter expiration = Higher price (generally for calls, lower for puts) | Time decay accelerates as expiration approaches. |

| Implied Volatility | Higher IV = Higher price | Higher implied volatility reflects greater uncertainty about the future price of the underlying asset. |

| Interest Rates | Higher rates = Higher call prices, Lower put prices | Interest rates influence the present value of future cash flows associated with the option. |

| Dividends | Expected dividends = Lower call prices, Higher put prices | Dividends reduce the underlying asset's future value, affecting call and put option values differently. |

| Open Interest | Higher open interest = generally increased liquidity | Higher open interest generally suggests greater liquidity, potentially influencing the bid-ask spread. |

Smooth Transition to Core Discussion

Let's now delve deeper into the core factors that influence option pricing differences, beginning with a detailed examination of each factor’s contribution to price variations.

Exploring the Key Aspects of Option Price Discrepancies

-

Time Decay (Theta): Options lose value as time approaches expiration. This time decay, also known as theta, accelerates as the expiration date nears. Two calls with identical strike prices and underlying assets but different expiration dates will have different prices, with the shorter-dated call usually being cheaper. This is because the shorter-dated option has less time for the underlying asset's price to move favorably and generate profit.

-

Implied Volatility (IV): Implied volatility is a crucial factor. It represents the market's expectation of future price fluctuations of the underlying asset. Higher implied volatility reflects greater uncertainty and leads to higher option premiums for both calls and puts. Two options with identical strike prices and expiration dates but different implied volatilities will trade at different prices. This discrepancy arises from the market’s differing assessment of the underlying asset's price volatility.

-

Interest Rates: Interest rates influence option prices, particularly for longer-dated options. Higher interest rates generally increase the value of call options and decrease the value of put options. This is because higher interest rates increase the opportunity cost of holding the underlying asset (for calls) and decrease the present value of potential losses (for puts).

-

Dividends: Dividend payments impact option prices. If the underlying asset is expected to pay a dividend before the option's expiration, the value of call options will typically be reduced, and the value of put options will be slightly increased. This is because the dividend payment reduces the value of the underlying asset at expiration, affecting the potential profit from calls and the potential loss from puts.

-

Open Interest and Liquidity: While not directly affecting the theoretical price, the open interest (the number of outstanding contracts) and liquidity of an option contract play a vital role in its actual market price. Options with higher open interest usually experience tighter bid-ask spreads due to greater trading volume and liquidity. Lower liquidity can lead to wider spreads and make the option appear more expensive or cheaper than theoretically predicted.

-

Market Sentiment and Supply/Demand: Market sentiment, representing the overall feeling of optimism or pessimism towards the underlying asset, significantly influences option prices. Strong positive sentiment can drive up demand for call options, increasing their prices even if other factors remain unchanged. Conversely, bearish sentiment can increase put option prices.

Closing Insights

Option pricing is not solely determined by strike price and underlying asset; it’s a multifaceted process influenced by a complex interplay of time decay, implied volatility, interest rates, dividends, open interest and market sentiment. Understanding these factors is crucial for correctly interpreting option prices and developing profitable trading strategies. Overlooking these elements can lead to inaccurate assessments of risk and potentially disastrous trading decisions.

Exploring the Connection Between Implied Volatility and Option Price Discrepancies

Implied volatility is arguably the most significant factor driving price differences between options contracts with the same strike price and issuer. Its role is crucial because it reflects the market’s expectations of future price swings. A higher implied volatility implies a greater chance of larger price movements, making options with higher implied volatility more expensive than those with lower implied volatility, even if all other factors remain constant.

For example, consider two call options on the same stock with identical strike prices and expiration dates. If one option trades on a day with higher perceived risk (e.g., during a period of market uncertainty), its implied volatility will likely be higher, resulting in a higher premium compared to the same option traded on a calmer day with lower implied volatility. The market is essentially pricing in a higher chance of large price movements, hence the higher premium.

Further Analysis of Implied Volatility

| IV Level | Market Interpretation | Impact on Option Price |

|---|---|---|

| Low | Low expected volatility | Lower option premiums |

| Moderate | Moderate expected volatility | Moderate option premiums |

| High | High expected volatility | Higher option premiums |

Implied volatility is not directly observable but is derived from option prices using pricing models like the Black-Scholes model. Traders closely monitor changes in implied volatility as it is a key indicator of market sentiment and risk assessment. Understanding the dynamics of implied volatility is essential for formulating effective trading strategies. A surge in implied volatility, for instance, may present an opportunity to sell options at a higher premium, while a decline may signal a favorable time to buy.

FAQ Section

-

Q: Can I use the Black-Scholes model to perfectly predict option prices? A: The Black-Scholes model provides a theoretical framework, but it relies on assumptions that may not always hold true in real markets (e.g., constant volatility). It's a valuable tool, but it should not be seen as a flawless predictor of option prices.

-

Q: How do dividends affect put options differently than call options? A: Dividends reduce the value of the underlying asset. This benefits put option holders (who profit from a decrease in the underlying asset's value), while it hurts call option holders (who profit from an increase).

-

Q: What is the significance of open interest? A: Higher open interest generally indicates greater liquidity, leading to tighter bid-ask spreads and potentially lower transaction costs. Options with low open interest might experience wider spreads, making them less attractive for trading.

-

Q: How can I track implied volatility? A: Many financial websites and trading platforms provide real-time data on implied volatility for various options contracts.

-

Q: Is it better to buy options with longer or shorter expirations? A: The optimal expiration depends on your trading strategy and risk tolerance. Longer expirations offer more time for the underlying asset's price to move favorably, but they also increase time decay risk.

-

Q: Are there other models besides Black-Scholes used for option pricing? A: Yes, numerous other models exist, often addressing the limitations of the Black-Scholes model, such as the binomial and trinomial models. More advanced models incorporate stochastic volatility and jumps.

Practical Tips

-

Analyze Implied Volatility: Before trading options, carefully examine the implied volatility of the contracts. Higher IV suggests higher risk and potential reward.

-

Consider Time Decay: Understand how time decay affects options prices, particularly as expiration approaches.

-

Monitor Interest Rates: Be aware of how changes in interest rates can impact option values.

-

Factor in Dividends: Account for the impact of upcoming dividend payments on option prices.

-

Assess Liquidity: Choose liquid options to minimize transaction costs and slippage.

-

Use Option Pricing Models: Employ option pricing models (carefully considering their limitations) to evaluate fair value.

-

Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your options positions across different assets and expiration dates.

-

Practice Risk Management: Implement sound risk management techniques, including stop-loss orders and position sizing.

Final Conclusion

The difference in prices between seemingly identical options contracts highlights the complexities inherent in option pricing. While the strike price and underlying asset are crucial, understanding the interplay of time decay, implied volatility, interest rates, dividends, open interest, and market sentiment is paramount for making informed trading decisions. By diligently analyzing these factors, traders can gain a significant advantage and navigate the dynamic world of options trading more effectively. Remember that continuous learning and a disciplined approach are essential for long-term success in this challenging yet rewarding market.

Latest Posts

Related Post

Thank you for visiting our website which covers about Why Are The Two Options Contracts With The Same Exercise Price Of The Same Issuer Priced Differently . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.