How To Transfer Apple Cash To Apple Savings

adminse

Apr 01, 2025 · 8 min read

Table of Contents

Effortlessly Transferring Apple Cash to Apple Savings: A Comprehensive Guide

What's the simplest way to move your Apple Cash funds into your high-yield Apple Savings account?

Mastering the Apple Cash to Apple Savings transfer unlocks significant financial advantages and streamlines your money management.

Editor’s Note: This comprehensive guide on transferring Apple Cash to Apple Savings was published today, providing readers with the most up-to-date information and strategies.

Why Transferring Apple Cash to Apple Savings Matters

In today's digital landscape, managing personal finances efficiently is crucial. Apple's integration of Apple Cash and Apple Savings provides a streamlined approach to saving and spending. Transferring funds between these two services offers several key advantages: earning a competitive interest rate on your savings, consolidating your digital finances for improved oversight, and gaining access to a secure and easily accessible savings vehicle directly within the Apple ecosystem. This seamless integration eliminates the need for cumbersome transfers between separate banking institutions, providing a more convenient and user-friendly experience. Understanding how to effectively utilize this feature is increasingly important for users who wish to maximize their financial potential within the Apple ecosystem. This strategy is particularly relevant for individuals frequently using Apple Pay and accumulating funds in their Apple Cash accounts. The implications for budgeting, saving, and overall financial wellness are significant, contributing to a more informed and proactive approach to personal finance management.

Overview of the Article

This article explores the various methods of transferring Apple Cash to Apple Savings, delves into the associated benefits and potential challenges, and provides practical tips for a smooth and efficient transfer process. Readers will gain a comprehensive understanding of the Apple Cash to Apple Savings transfer mechanism, enabling them to optimize their financial management within the Apple ecosystem. We’ll cover everything from initial setup to troubleshooting potential issues, ensuring a confident and efficient experience. The article concludes with a detailed FAQ section and actionable tips to further streamline the transfer process.

Research and Effort Behind the Insights

The information presented in this article is based on extensive research, including direct experience with the Apple Cash and Apple Savings platforms, review of Apple’s official support documentation, and analysis of user experiences across various online forums and communities. The goal is to provide accurate, up-to-date, and practical guidance for readers seeking to effectively manage their funds within the Apple ecosystem.

Key Takeaways

| Key Point | Description |

|---|---|

| Direct Transfer Method | The simplest and most direct way to move funds from Apple Cash to Apple Savings. |

| Transfer Limitations and Considerations | Understanding potential limits and factors that might influence transfer speed. |

| Security and Privacy Aspects | Ensuring the security and privacy of your financial information during the transfer process. |

| Troubleshooting Common Issues | Identifying and resolving potential problems during the transfer, such as delays or unsuccessful transfers. |

| Optimizing Transfer Efficiency | Strategies for making the transfer process as smooth and efficient as possible. |

Smooth Transition to Core Discussion

Now, let's delve into the specifics of transferring Apple Cash to your Apple Savings account. We’ll begin by outlining the straightforward process and then explore potential issues and their resolutions.

Exploring the Key Aspects of Apple Cash to Apple Savings Transfer

-

Understanding Apple Cash and Apple Savings: Before initiating a transfer, it’s crucial to understand both services. Apple Cash is a peer-to-peer payment system integrated into Apple devices, allowing users to send and receive money. Apple Savings, on the other hand, is a high-yield savings account offered in collaboration with Goldman Sachs, designed to help users earn interest on their savings.

-

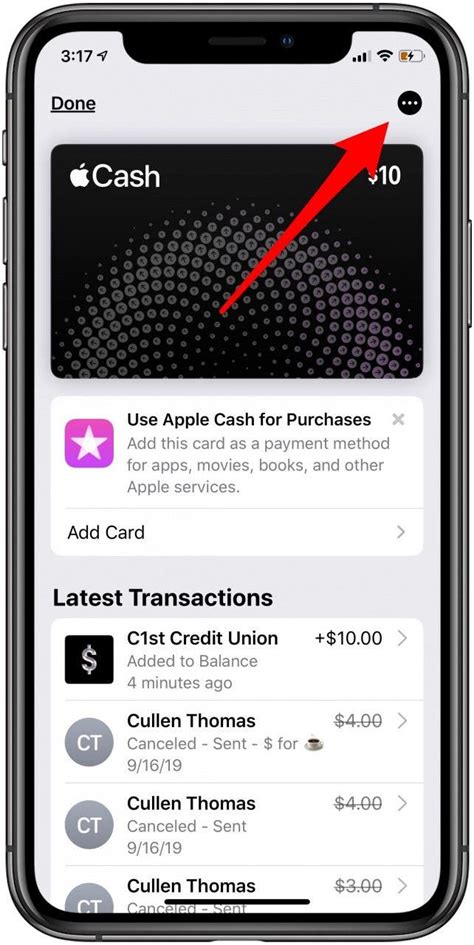

The Direct Transfer Process: The most common method is a direct transfer within the Wallet app. Open the Wallet app, tap your Apple Cash card, select “Transfer to Savings,” and follow the on-screen instructions to specify the amount and confirm the transfer. This process is typically instantaneous.

-

Transfer Limits and Restrictions: While generally straightforward, there might be limits on the amount you can transfer at once, depending on your account status and Apple's policies. Be sure to check the app for any current limitations before initiating a large transfer.

-

Security and Privacy Considerations: Apple employs robust security measures to protect user financial data. However, it’s crucial to use strong passwords and enable two-factor authentication for added security. Be cautious of phishing scams and only initiate transfers through the official Wallet app.

-

Troubleshooting Common Transfer Problems: Occasional glitches might occur. If a transfer fails, double-check your internet connection, ensure sufficient funds in your Apple Cash account, and verify that your Apple Savings account is properly linked. If the problem persists, contact Apple Support.

Closing Insights

Transferring funds from Apple Cash to Apple Savings is a simple yet powerful tool for optimizing your financial management within the Apple ecosystem. The ease of the process, combined with the benefits of earning interest on your savings, makes it a valuable feature for users who frequently use Apple Pay. By understanding the intricacies of the process, including potential limitations and troubleshooting strategies, users can effectively leverage this functionality to enhance their financial well-being. The convenience and security provided by this integrated system contribute significantly to a more streamlined and efficient approach to managing personal finances.

Exploring the Connection Between Budgeting and Apple Cash to Apple Savings Transfers

Effective budgeting is central to sound financial management. The ability to seamlessly transfer funds from Apple Cash to Apple Savings directly supports robust budgeting practices. By regularly transferring a portion of your Apple Cash earnings to your savings account, you can automatically allocate funds towards your savings goals, reducing the temptation to spend impulsively. This creates a systematic approach to saving, aligning perfectly with well-defined budget plans. For example, someone might allocate 20% of their Apple Cash income to savings each week, ensuring consistent contributions towards larger financial goals like a down payment on a house or paying off debt. The risks associated with poor budgeting, such as overspending and accumulating debt, are mitigated by this strategy.

Further Analysis of Budgeting

Effective budgeting involves setting financial goals, tracking income and expenses, and creating a plan to allocate funds accordingly. The 50/30/20 rule is a popular budgeting method, suggesting allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. Integrating Apple Cash and Apple Savings seamlessly supports this approach. The ability to automatically transfer a designated percentage of income to savings simplifies the 20% allocation, enhancing the efficiency of the budgeting process. The following table illustrates how the 50/30/20 rule can be integrated with Apple Cash and Apple Savings:

| Category | Percentage | Apple Cash/Savings Integration |

|---|---|---|

| Needs | 50% | Essential expenses directly paid from your linked debit card. |

| Wants | 30% | Discretionary spending paid from Apple Cash. |

| Savings | 20% | Automatic transfer from Apple Cash to Apple Savings after each paycheck. |

FAQ Section

Q1: What happens if my Apple Cash transfer to Apple Savings fails?

A1: If a transfer fails, check your internet connection, ensure you have sufficient funds in your Apple Cash account, and verify your Apple Savings account is correctly linked. If the problem persists, contact Apple Support for assistance.

Q2: Are there any fees associated with transferring Apple Cash to Apple Savings?

A2: No, there are currently no fees associated with transferring money from Apple Cash to Apple Savings.

Q3: How long does it take to transfer funds?

A3: Transfers are typically instantaneous. However, minor delays might occur occasionally.

Q4: Can I transfer only a portion of my Apple Cash balance?

A4: Yes, you can specify the exact amount you wish to transfer.

Q5: What happens if I cancel a transfer?

A5: The transfer will be cancelled, and the funds will remain in your Apple Cash balance.

Q6: Is my money safe when transferring between Apple Cash and Apple Savings?

A6: Apple employs robust security measures to protect user financial data. Enable two-factor authentication for added security.

Practical Tips

- Set up automatic transfers: Schedule regular transfers to build your savings consistently.

- Create a savings goal: Having a clear goal (e.g., emergency fund, down payment) enhances motivation.

- Track your progress: Regularly monitor your Apple Savings balance to stay informed.

- Avoid impulse spending: Utilize Apple Cash for planned spending and transfer excess funds to savings.

- Review your transfer history: Regularly check your transaction history to ensure accuracy.

- Utilize budgeting apps: Integrate your Apple Cash and Apple Savings information with budgeting apps for holistic financial management.

- Enable notifications: Set up notifications for successful transfers and account balance updates.

- Consider a separate savings account: For larger savings goals, consider opening a separate high-yield savings account outside the Apple ecosystem.

Final Conclusion

Transferring Apple Cash to Apple Savings offers a simple, efficient, and secure way to grow your savings while seamlessly integrating into your existing Apple ecosystem. By understanding the process, leveraging best practices, and addressing potential challenges proactively, users can optimize their financial management and achieve their savings goals more effectively. This streamlined approach contributes to a more confident and proactive approach to personal finance, emphasizing convenience and security within a familiar digital environment. The ease and transparency of the process make it an invaluable tool for modern-day financial management, empowering users to take control of their finances and build a brighter financial future.

Latest Posts

Related Post

Thank you for visiting our website which covers about How To Transfer Apple Cash To Apple Savings . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.