Pushdown Accounting Definition How It Works Example

adminse

Mar 31, 2025 · 9 min read

Table of Contents

Pushdown Accounting: A Deep Dive into Definition, Mechanics, and Real-World Examples

What is the true impact of pushdown accounting on financial reporting, and how does it differ from other accounting methods?

Pushdown accounting offers a unique lens for understanding the financial health of subsidiaries, providing invaluable insights for investors and stakeholders alike.

Editor’s Note: This comprehensive guide to pushdown accounting was published today.

Why Pushdown Accounting Matters

Pushdown accounting, while not as widely used as other methods, plays a crucial role in accurately reflecting the financial position of a subsidiary following an acquisition where the parent company acquires a significant portion (often over 50%) of the subsidiary's equity. Understanding its nuances is vital for anyone involved in mergers and acquisitions (M&A), financial analysis, or corporate accounting. It directly impacts the presentation of consolidated financial statements, influencing key metrics such as equity, assets, and liabilities. This method, unlike the more common "full goodwill" method, directly affects the subsidiary's own financial statements, offering a more transparent picture of its post-acquisition performance, independent of the parent company's overall financial health. The impact ripples through financial ratios, creditworthiness assessments, and investor decisions, making it a significant factor in the success of post-acquisition integration and long-term financial stability.

Overview of the Article

This article will explore the core principles of pushdown accounting, detailing how it works compared to alternative methods. It will provide clear examples to illustrate its practical application, examining the implications for financial reporting and analysis. Readers will gain a comprehensive understanding of its benefits, limitations, and the circumstances under which it’s most appropriate. We will delve into the accounting treatment of assets, liabilities, and equity under pushdown accounting, and analyze the connection between fair value adjustments and the ultimate presentation of financial data.

Research and Effort Behind the Insights

This article draws upon extensive research from authoritative accounting standards like IFRS and GAAP, relevant case studies, and industry best practices. The analysis integrates various financial models and theoretical frameworks to offer a comprehensive and nuanced understanding of pushdown accounting.

Key Takeaways

| Key Aspect | Description |

|---|---|

| Definition | Accounting method where the subsidiary's books reflect the fair value of acquired assets and liabilities. |

| Application | Primarily used after acquisitions where the parent company gains significant control (often >50% ownership). |

| Impact on Financial Statements | Directly affects the subsidiary's balance sheet and income statement. |

| Difference from Other Methods | Unlike full goodwill, it doesn't leave the subsidiary with historical cost-based accounts. |

| Benefits | Increased transparency, better reflection of post-acquisition value, simplified consolidated statements. |

| Limitations | Can be complex to implement, requires thorough valuation, may affect management incentives. |

Smooth Transition to Core Discussion

Let's delve into the specifics of pushdown accounting, examining its foundational principles, practical applications, and the situations where it is most beneficial compared to alternative methods like the full goodwill method.

Exploring the Key Aspects of Pushdown Accounting

-

Definition and Applicability: Pushdown accounting is an accounting method applied specifically after a significant acquisition. It involves adjusting the subsidiary's accounting records to reflect the fair value of its assets and liabilities at the acquisition date. This is in contrast to the typical scenario where the subsidiary continues to maintain its historical cost basis, while only the consolidated financial statements of the parent company reflect the fair value adjustments. The key criterion for pushdown accounting is usually the parent company acquiring more than 50% of the subsidiary's voting shares, granting substantial control.

-

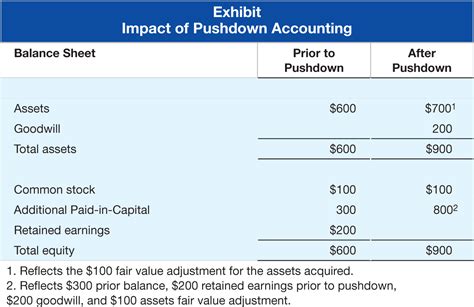

Mechanism and Adjustments: The process begins with a detailed valuation of the subsidiary's assets and liabilities at the acquisition date. Any difference between these fair values and the subsidiary's book values triggers adjustments to the subsidiary's balance sheet. These adjustments are made directly to the subsidiary's accounts, resulting in a revised equity section. For instance, if the fair value of the subsidiary's land is higher than its book value, the difference is added to the subsidiary's equity. Conversely, if the fair value of liabilities is higher than the book value, the difference increases the liabilities.

-

Impact on Financial Statements: The direct impact of pushdown accounting is apparent in both the balance sheet and the income statement of the subsidiary. The balance sheet shows the adjusted values for assets and liabilities, with a corresponding change in equity. This affects key ratios like debt-to-equity and return on assets, potentially influencing credit ratings and investor sentiment. The income statement reflects the impacts of any adjustments, affecting depreciation, amortization, and potentially other expense items.

-

Comparison with Full Goodwill Method: The full goodwill method, in contrast, only reflects fair value adjustments in the parent company's consolidated financial statements. The subsidiary continues to operate with its historical cost basis. This results in a goodwill amount being recognized on the parent company’s balance sheet to capture the difference between the acquisition price and the net fair value of the identifiable assets and liabilities acquired. Pushdown accounting eliminates the need for consolidating entries related to the fair value adjustments which simplifies the process.

-

Tax Implications: It's crucial to note that pushdown accounting can have implications for both the parent company and the subsidiary regarding taxation. Adjustments made may affect the taxable income and tax liability of both entities. Professional tax advice is crucial to handle these implications appropriately.

Closing Insights

Pushdown accounting provides a transparent and efficient way to reflect the true economic value of a subsidiary after an acquisition. By directly adjusting the subsidiary's books, it simplifies consolidated financial reporting and offers a clearer picture of the subsidiary's financial health. While more complex than alternative methods, the benefits in terms of clarity and ease of financial analysis often outweigh the implementation challenges. The decision to use pushdown accounting should be based on a thorough assessment of the acquisition, considering the complexity, costs, and potential tax implications.

Exploring the Connection Between Fair Value Adjustments and Pushdown Accounting

Fair value adjustments are the cornerstone of pushdown accounting. The process relies heavily on accurate and reliable valuations of assets and liabilities at the acquisition date. These valuations should be conducted by qualified professionals using appropriate valuation methodologies, taking into account market conditions, industry benchmarks, and the specific circumstances of the subsidiary. The significance of accurate fair value adjustments is paramount; inaccuracies can significantly distort the financial picture of the subsidiary, misleading stakeholders and potentially leading to flawed strategic decisions. This highlights the necessity of employing rigorous valuation techniques and engaging experienced valuation professionals.

Real-world examples can illustrate this point. Imagine a technology company acquiring a smaller software firm. The acquired firm may possess intellectual property (IP) not fully reflected on its books. A thorough valuation might reveal significant intangible assets, leading to a substantial increase in the subsidiary's equity through pushdown accounting. Conversely, if the subsidiary has under-provisioned for liabilities, a fair value adjustment will accurately reflect the true financial position. This transparency aids investors in assessing the acquired company's true worth.

Further Analysis of Fair Value Adjustments

| Factor | Cause-and-Effect | Significance | Applications |

|---|---|---|---|

| Asset Revaluation | Increases in fair value lead to higher equity for the subsidiary. | Impacts key financial ratios and provides a more accurate reflection of the asset base. | More accurate financial reporting, clearer picture of a company's true net worth. |

| Liability Revaluation | Increases in fair value of liabilities increase the subsidiary’s liabilities. | Impacts debt-to-equity ratio, creditworthiness, and the subsidiary's financial stability. | Accurate reflection of financial risks, informing credit decisions and risk assessment. |

| Impairment of Assets | If assets are found to be impaired below their carrying value, a write-down is needed. | Can significantly affect the subsidiary’s profitability and financial position. | Accurate reporting of losses and impairment charges. |

| Valuation Methodologies | The choice of valuation method (e.g., market, income, cost) impacts the results. | Accuracy of the fair value depends on the appropriateness of the chosen method. | Selecting the most suitable method is crucial for reliable results. |

FAQ Section

-

What is the main difference between pushdown and full goodwill accounting? Pushdown accounting directly adjusts the subsidiary's books, while full goodwill only adjusts the consolidated statements of the parent company.

-

When is pushdown accounting most appropriate? It's typically used when the parent company acquires a significant majority of the subsidiary's shares (often >50%).

-

What are the potential drawbacks of pushdown accounting? It can be complex and costly to implement, requiring thorough valuations and potentially affecting management incentives.

-

How does pushdown accounting affect the subsidiary's income statement? Adjustments to asset and liability values will affect depreciation, amortization, and other expense items.

-

Who is responsible for performing the fair value adjustments? Qualified valuation professionals should conduct the valuations, adhering to established accounting standards.

-

Can pushdown accounting be used for all types of acquisitions? No, it’s generally restricted to acquisitions where significant control is established (usually above 50%).

Practical Tips

-

Engage Valuation Experts: Hire experienced professionals to perform fair value adjustments.

-

Document Thoroughly: Maintain comprehensive documentation of the valuation process and adjustments.

-

Adhere to Accounting Standards: Comply strictly with relevant accounting standards (IFRS or GAAP).

-

Assess Tax Implications: Consult tax professionals regarding the tax implications of the adjustments.

-

Integrate with Post-Acquisition Planning: Integrate pushdown accounting into the overall post-acquisition integration strategy.

-

Monitor Post-Acquisition Performance: Continuously monitor the subsidiary’s performance after implementing pushdown accounting.

-

Consider Internal Controls: Implement robust internal controls to ensure the accuracy of the adjusted financial statements.

-

Communicate Effectively: Clearly communicate the implications of pushdown accounting to stakeholders.

Final Conclusion

Pushdown accounting, while complex, offers a superior level of transparency and accuracy in reflecting the true financial state of a subsidiary post-acquisition. By shifting the fair value adjustments to the subsidiary's books, it simplifies consolidated reporting and provides invaluable insights for stakeholders. However, careful planning, thorough valuation, and adherence to accounting standards are crucial for successful implementation. Understanding the intricacies of pushdown accounting is essential for anyone involved in M&A, financial analysis, or corporate accounting. The benefits of enhanced transparency and accurate financial reporting significantly outweigh the complexities involved, making it a powerful tool for achieving successful post-acquisition integration and sustainable financial health. Further exploration of the practical applications and nuances of pushdown accounting across various industries will continue to illuminate its importance in the world of corporate finance.

Latest Posts

Related Post

Thank you for visiting our website which covers about Pushdown Accounting Definition How It Works Example . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.