Real Rate Of Return Definition How Its Used And Example

adminse

Apr 01, 2025 · 9 min read

Table of Contents

Unlocking the True Power of Your Investments: Understanding the Real Rate of Return

What truly reflects the success of your investment? Is it the nominal return, or is there a deeper, more accurate measure?

The real rate of return provides a far more insightful picture of investment performance by accounting for the corrosive effects of inflation.

Editor’s Note: This comprehensive guide to the real rate of return has been published today to provide investors with the knowledge needed to accurately assess investment performance.

Why the Real Rate of Return Matters

In the world of finance, understanding returns is paramount. While the nominal rate of return—the simple percentage increase in your investment's value—is readily available, it paints an incomplete picture. Inflation, the persistent increase in the general price level of goods and services, silently erodes the purchasing power of your returns. This is where the real rate of return steps in, offering a more accurate reflection of your investment's true growth. Understanding the real rate of return is crucial for informed decision-making, whether you're planning for retirement, saving for a down payment, or managing a portfolio. It allows for accurate comparisons between different investments and helps set realistic expectations about future growth. Neglecting inflation's impact can lead to inaccurate assessments of investment success and potentially flawed financial planning.

Overview of the Article

This article delves into the intricacies of the real rate of return, exploring its definition, calculation methods, practical applications, and limitations. We will examine how to calculate the real rate of return, considering different inflation measurement approaches. Further, we will analyze its significance in various financial contexts, including retirement planning, portfolio management, and comparing investment options. Real-world examples will illustrate its practical use, and we’ll address common misconceptions and limitations. By the end, readers will possess a solid understanding of this crucial financial metric and its importance in making sound investment decisions.

Research and Effort Behind the Insights

The information presented in this article is based on extensive research, drawing upon established financial principles, academic literature, and data from reputable sources such as the Bureau of Labor Statistics (BLS) for inflation data and financial market indices for return data. The analysis presented aims for clarity and accuracy, providing investors with a reliable framework for understanding and applying the real rate of return concept.

Key Takeaways

| Key Concept | Description |

|---|---|

| Real Rate of Return | The adjusted rate of return that accounts for the impact of inflation on purchasing power. |

| Nominal Rate of Return | The stated rate of return without adjusting for inflation. |

| Inflation Rate | The percentage increase in the general price level of goods and services. |

| Fisher Equation | An approximate formula used to estimate the real rate of return. (approximately Real Rate = Nominal Rate - Inflation Rate) |

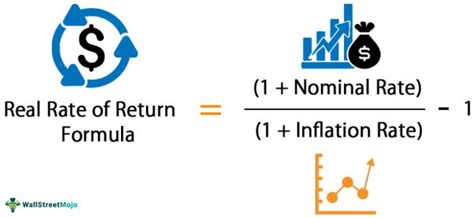

| Exact Real Rate of Return | A more precise calculation using the formula: (1 + Nominal Rate) / (1 + Inflation Rate) - 1 |

Smooth Transition to Core Discussion

Let's now delve into a deeper understanding of the real rate of return, starting with its precise definition and the methods for calculating it.

Exploring the Key Aspects of the Real Rate of Return

-

Defining the Real Rate of Return: The real rate of return represents the true increase in the purchasing power of an investment after accounting for inflation. It shows how much more you can actually buy with your investment's earnings, considering the decrease in purchasing power caused by rising prices.

-

Calculating the Real Rate of Return: There are two primary methods:

-

The Approximate Method (Fisher Equation): This simplified formula subtracts the inflation rate from the nominal rate of return:

Real Rate ≈ Nominal Rate - Inflation Rate. While convenient, this method is only accurate when inflation rates are relatively low. -

The Exact Method: This more precise approach uses the following formula:

Real Rate = [(1 + Nominal Rate) / (1 + Inflation Rate)] - 1. This method provides a more accurate representation, especially when dealing with higher inflation rates.

-

-

Inflation Measurement: The accuracy of the real rate of return depends heavily on the accuracy of the inflation rate used. Commonly used inflation indices include the Consumer Price Index (CPI) and the Producer Price Index (PPI). The choice of index depends on the specific context of the investment and the type of goods and services the investor is interested in.

-

Applications of the Real Rate of Return: The real rate of return is crucial for various financial decisions:

-

Investment Comparison: Comparing investments based solely on nominal returns can be misleading. The real rate of return allows for a fairer comparison, enabling investors to choose investments that truly maximize their purchasing power.

-

Retirement Planning: Accurate retirement planning requires understanding how inflation will affect future expenses. The real rate of return helps project future purchasing power, ensuring sufficient funds for retirement needs.

-

Portfolio Management: Asset allocation strategies benefit significantly from using the real rate of return. It allows for better risk assessment and optimization of portfolio performance in real terms.

-

-

Limitations of the Real Rate of Return: While valuable, the real rate of return has some limitations:

-

Inflation Prediction: Accurate inflation forecasting is challenging, and using an incorrect inflation rate leads to inaccurate real rate calculations.

-

Index Choice: Different inflation indices can yield varying results, highlighting the importance of choosing the appropriate index for the specific situation.

-

Tax Implications: The real rate of return doesn't directly account for taxes, which further reduce the after-tax real return.

-

Closing Insights

The real rate of return is an indispensable tool for investors seeking to understand the true performance of their investments. By accounting for the effects of inflation, it offers a more accurate and insightful perspective than the nominal rate of return. Its application spans various financial decisions, from comparing investment options to planning for retirement. While limitations exist concerning inflation prediction and index choice, understanding and utilizing the real rate of return significantly improves investment decision-making and wealth management strategies.

Exploring the Connection Between Risk and the Real Rate of Return

Higher risk investments generally offer higher nominal returns. However, this does not automatically translate to higher real returns. The relationship between risk and the real rate of return is complex and depends on how the investment's return correlates with inflation. For example, during periods of high inflation, investments in real assets like real estate or commodities may offer better protection against inflation erosion, resulting in higher real returns than risk-free assets like government bonds. Conversely, during periods of low inflation, the higher nominal return of riskier assets might not necessarily translate to significantly higher real returns after adjusting for inflation. This underscores the importance of considering both risk and inflation when making investment decisions.

Further Analysis of Inflation's Impact

Inflation's impact on investment returns is multifaceted. Unexpected inflation can significantly erode the purchasing power of future returns, especially for fixed-income investments. Inflation also impacts the discount rate used in present value calculations, affecting the valuation of future cash flows. Furthermore, inflation can influence investor sentiment and market behavior, potentially impacting asset prices and returns. The following table illustrates the impact of inflation on a $100 investment over 10 years with different nominal returns and inflation rates:

| Nominal Return | Inflation Rate | Real Return (Approximate) | Real Return (Exact) |

|---|---|---|---|

| 5% | 2% | 3% | 2.94% |

| 8% | 4% | 4% | 3.84% |

| 10% | 6% | 4% | 3.77% |

| 12% | 8% | 4% | 3.70% |

FAQ Section

-

Q: What's the difference between the nominal and real rate of return? A: The nominal rate is the stated return, while the real rate adjusts for inflation, showing the increase in purchasing power.

-

Q: Which inflation index is best to use? A: It depends on the investment and your spending habits. CPI is commonly used for consumer goods, while PPI focuses on producer prices.

-

Q: How does the real rate of return affect retirement planning? A: It ensures you project the correct amount needed for retirement, accounting for future inflation.

-

Q: Is the Fisher equation always accurate? A: No, it's an approximation, more accurate at lower inflation rates. The exact method is more precise.

-

Q: How can I calculate the real rate of return? A: Use the approximate method (Nominal Rate - Inflation Rate) or the more accurate exact method: [(1 + Nominal Rate) / (1 + Inflation Rate)] - 1.

-

Q: Why is the real rate of return important for comparing investments? A: It allows for a fair comparison, eliminating the distortion caused by inflation, ensuring you choose the investment that truly maximizes your purchasing power.

Practical Tips

-

Track Inflation: Regularly monitor inflation rates using reputable sources like the BLS.

-

Use the Exact Method: For greater accuracy, especially with higher inflation, utilize the exact formula for calculating the real rate of return.

-

Consider Different Indices: Explore various inflation indices to get a comprehensive view of inflation's potential impact on your investments.

-

Diversify Your Portfolio: Reduce your exposure to inflation risk by diversifying your investments across different asset classes.

-

Factor in Taxes: Remember to adjust your real rate of return to account for taxes, to get a true after-tax real return.

-

Regularly Review: Periodically recalculate the real rate of return on your investments to ensure your strategy aligns with your goals.

-

Consult a Financial Advisor: Seek professional advice for personalized investment strategies considering your risk tolerance and financial goals.

Final Conclusion

Understanding the real rate of return is fundamental to successful investing. By meticulously accounting for the impact of inflation, investors can make informed decisions, optimize portfolio performance, and accurately assess the true growth of their investments. While the concept might seem complex initially, mastering its calculation and application empowers investors to achieve their financial objectives more effectively, ensuring their wealth grows not just nominally but also in terms of its actual purchasing power. Continue to learn and refine your understanding of this crucial metric to navigate the financial landscape more effectively.

Latest Posts

Related Post

Thank you for visiting our website which covers about Real Rate Of Return Definition How Its Used And Example . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.