What Are Options Contracts

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Unlocking the Potential of Options Contracts: A Comprehensive Guide

What makes understanding options contracts crucial for savvy investors?

Options contracts offer a powerful toolkit for managing risk, generating income, and leveraging market opportunities, transforming how investors approach the financial landscape.

Editor’s Note: This comprehensive guide to options contracts has been published today, providing readers with up-to-date information and insights into this dynamic financial instrument.

Why Options Contracts Matter

Options contracts are derivative instruments, meaning their value is derived from an underlying asset. This underlying asset can be almost anything—stocks, indices, commodities, currencies, even interest rates. Their importance stems from their unique ability to provide flexibility and leverage not found in traditional investments like stocks or bonds. Options allow investors to define their risk and reward profiles precisely, tailoring their strategies to specific market outlooks. Understanding options opens doors to sophisticated trading strategies that can significantly enhance portfolio performance and mitigate potential losses. The ability to profit from both rising and falling markets, as well as to hedge against adverse price movements, makes options contracts a valuable tool for both experienced and aspiring investors. Furthermore, the options market provides valuable insights into market sentiment and future price expectations, offering a unique perspective on the overall health and direction of various assets.

Overview of the Article

This article explores the key aspects of options contracts, delving into their fundamental mechanics, various types, common strategies, and potential risks. Readers will gain a thorough understanding of how options work, enabling them to make informed decisions and potentially incorporate them into their investment strategies. We will also explore the connection between options and risk management, demonstrating their utility in protecting portfolios from unexpected market volatility.

Research and Effort Behind the Insights

This article is based on extensive research, drawing from reputable financial textbooks, scholarly articles, and practical experience in the options market. Data from leading financial institutions and market analysis reports have been integrated to provide a balanced and insightful perspective. The aim is to present a clear, concise, and accurate representation of options contracts, demystifying their complexities for a broader audience.

Key Takeaways

| Key Concept | Description |

|---|---|

| Call Option | Gives the buyer the right, but not the obligation, to buy the underlying asset at a specific price (strike price) by a certain date (expiration date). |

| Put Option | Gives the buyer the right, but not the obligation, to sell the underlying asset at a specific price (strike price) by a certain date (expiration date). |

| Strike Price (Exercise Price) | The price at which the option buyer can buy (call) or sell (put) the underlying asset. |

| Expiration Date | The date on which the option contract expires and becomes worthless if not exercised. |

| Premium | The price paid by the buyer to acquire the option contract. |

| Intrinsic Value | The difference between the underlying asset's price and the strike price (positive for in-the-money options). |

| Time Value | The portion of the option's premium reflecting the time remaining until expiration. |

Smooth Transition to Core Discussion

Let's dive deeper into the key aspects of options contracts, beginning with their fundamental characteristics and progressing to more advanced strategies and risk considerations.

Exploring the Key Aspects of Options Contracts

-

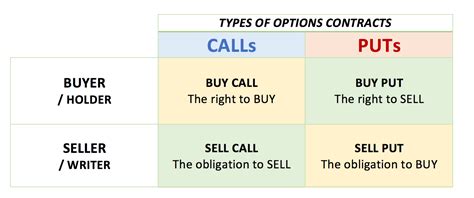

Understanding Option Types: As mentioned, the two primary options are calls and puts. Call options are purchased when an investor anticipates a price increase in the underlying asset. Put options are bought when an investor expects a price decrease. Understanding the difference is fundamental to employing options effectively.

-

Option Pricing Mechanics: Option premiums are influenced by several factors, including the underlying asset's price, the strike price, time to expiration, implied volatility, and interest rates. Implied volatility, a measure of market expectation of future price fluctuations, is a particularly significant factor. Higher implied volatility generally leads to higher option premiums. Understanding these factors is crucial for accurate option valuation and strategic decision-making.

-

Profit and Loss Profiles: Each option strategy has a distinct profit/loss profile. For example, a long call option has limited risk (the premium paid) but unlimited profit potential. Conversely, a long put option has limited risk (the premium paid) but limited profit potential (the strike price minus the premium). Understanding these profiles is critical for managing risk and achieving desired outcomes.

-

Options Strategies: Beyond simple long calls and puts, there's a wide array of strategies, including covered calls, protective puts, straddles, strangles, and spreads. These strategies utilize combinations of calls and puts to achieve specific objectives, such as generating income, hedging against risk, or speculating on price movements. The complexity increases significantly as you explore these advanced techniques.

-

Risk Management with Options: Options are particularly valuable for risk management. Protective puts can safeguard against potential losses in a portfolio's holdings, while covered calls can generate income from existing long positions. Options allow investors to fine-tune their risk exposure, protecting capital while maintaining potential for gains.

-

Options and Market Sentiment: The options market itself offers insights into market sentiment. High demand for call options (buying calls) might indicate bullish sentiment, while high demand for put options (buying puts) could suggest bearish sentiment. Analyzing option volumes and open interest can provide a valuable, albeit not always accurate, perspective on market expectations.

Closing Insights

Options contracts are not merely speculative instruments; they are powerful tools enabling investors to manage risk, generate income, and capitalize on market opportunities. Understanding their mechanics, various types, and inherent risks is crucial for responsible utilization. By carefully assessing market conditions and employing appropriate strategies, investors can leverage the flexibility and potential of options to enhance their overall portfolio performance. The complexity involved necessitates a thorough understanding, and seeking guidance from financial professionals may be advisable for beginners.

Exploring the Connection Between Volatility and Options Contracts

Volatility plays a crucial role in determining options prices. Higher volatility means greater uncertainty in the future price of the underlying asset. This uncertainty increases the value of options because they provide a hedge against potential large price swings. Options buyers benefit from high volatility, as the premium paid for the option increases with volatility. Options sellers, on the other hand, face higher risk in high volatility environments, as the potential for large losses grows.

Real-world examples abound: during periods of market uncertainty, such as the onset of a pandemic or geopolitical crisis, option prices tend to spike due to increased volatility. Investors seeking protection often buy put options, driving up their demand and premiums.

Further Analysis of Volatility

| Volatility Level | Impact on Options Prices | Implied Volatility | Options Strategies |

|---|---|---|---|

| Low | Lower option premiums | Low | Selling covered calls |

| High | Higher option premiums | High | Buying protective puts |

| Moderate | Moderate option premiums | Moderate | Buying or selling spreads |

Volatility's impact isn't solely limited to pricing. It also affects the success or failure of various options strategies. High volatility can lead to significant gains or losses for those employing complex strategies like spreads and straddles. Careful analysis of volatility is essential for successful options trading.

FAQ Section

-

What is the difference between a long call and a short call? A long call gives the buyer the right to buy; a short call obligates the seller to sell if the buyer exercises.

-

How do I determine the appropriate strike price? Consider your market outlook and risk tolerance. Strike prices closer to the current market price offer higher probability of profit but lower potential gains.

-

What are the risks associated with options trading? The primary risk is losing the entire premium paid. More complex strategies carry even higher risks.

-

Can options be used for hedging? Yes, protective puts and other strategies can help hedge against downside risk in a portfolio.

-

What is implied volatility, and why is it important? Implied volatility reflects market expectations of future price fluctuations and significantly impacts option pricing.

-

Where can I learn more about options trading? Reputable financial websites, books, and educational courses offer comprehensive information on options trading.

Practical Tips

- Start with education: Thoroughly understand options mechanics before trading.

- Paper trade: Practice with simulated accounts to refine strategies.

- Manage risk: Never risk more capital than you can afford to lose.

- Diversify: Don't put all your eggs in one options basket.

- Use stop-loss orders: Limit potential losses.

- Monitor positions: Regularly review and adjust strategies as needed.

- Consult professionals: Seek advice from experienced financial advisors.

- Stay updated: Market conditions and volatility affect options pricing.

Final Conclusion

Options contracts provide a sophisticated toolkit for managing risk and capitalizing on market opportunities. Their flexibility and leverage offer unique advantages to investors, but it's crucial to approach them with careful planning and a thorough understanding of the inherent risks. By mastering the fundamentals, practicing responsible risk management, and staying informed about market dynamics, investors can unlock the significant potential of options contracts and enhance their overall investment strategy. This guide serves as a starting point—continued learning and careful application are key to success in this dynamic and rewarding area of finance.

Latest Posts

Latest Posts

-

Put Provision Definition

Mar 31, 2025

-

Why Does Credit One Bank Keep Calling Me

Mar 31, 2025

-

What Is Credit Protection Credit One

Mar 31, 2025

-

Put On A Put Definition

Mar 31, 2025

-

Put Calendar Definition

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about What Are Options Contracts . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.