What Is Service Line Coverage On Homeowners Insurance

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Decoding Service Line Coverage on Homeowners Insurance: Protecting Your Hidden Assets

What hidden expenses could leave your homeowner's insurance policy woefully inadequate?

Service line coverage is a critical yet often overlooked component of comprehensive homeowner protection, safeguarding your property against costly unforeseen repairs.

Editor’s Note: This comprehensive guide to service line coverage on homeowners insurance was published today, providing up-to-date insights into this essential aspect of property protection.

Why Service Line Coverage Matters

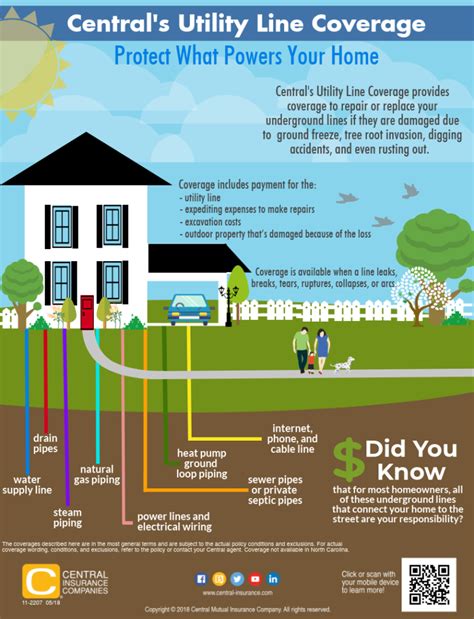

Most homeowners focus on the obvious: protecting their house and its contents from fire, theft, or weather damage. However, the underground infrastructure connecting your home to essential services—water, sewer, gas, and electrical lines—is often neglected. Damage to these service lines, often located on your property but beyond the structure's walls, can lead to significant and unexpected repair bills. These lines are frequently not covered under standard homeowners insurance policies, leaving you financially vulnerable. The costs associated with repairing these lines can quickly reach thousands of dollars, placing a considerable burden on your finances. Understanding the nuances of service line coverage is crucial for protecting your investment and avoiding potentially devastating financial consequences. This applies to both single-family homes and multi-unit dwellings. The impact extends beyond the immediate financial burden; disruption to essential services can severely impact daily life, creating inconvenience and even health hazards.

Overview of this Article

This article will comprehensively explore service line coverage in homeowners insurance. We'll delve into its significance, the types of damage covered (and those typically excluded), the factors influencing cost, and how to ensure you have adequate protection. We'll also analyze the relationship between service line coverage and other homeowner's insurance components, providing practical tips for securing appropriate coverage and understanding policy nuances. This includes navigating common misconceptions and addressing frequently asked questions. The information presented is based on extensive research, incorporating industry reports and expert opinions to ensure accuracy and clarity.

Research and Effort Behind the Insights

This analysis draws on data from leading insurance providers, industry publications such as the Insurance Information Institute (III), and consultations with experienced insurance professionals. We have examined various policy documents and case studies to provide a well-rounded understanding of service line coverage, clarifying its importance and its often overlooked aspects.

Key Takeaways

| Key Point | Explanation |

|---|---|

| What it is: | Coverage for repairs to underground service lines on your property. |

| What it covers: | Typically covers water, sewer, gas, and electrical lines. Specific exclusions vary by policy. |

| What it doesn't cover: | Usually excludes damage caused by pre-existing conditions, neglect, or lack of maintenance. Policy wording will specify exclusions. |

| Cost considerations: | Premium cost varies based on location, property value, and the level of coverage selected. |

| Importance of separate policy: | Service line coverage is often an add-on, highlighting the need to review your policy carefully and consider separate coverage if necessary. |

| Claim process: | Similar to other homeowner's claims; involves reporting damage, assessment by the insurer, and handling repairs according to policy terms. |

Smooth Transition to Core Discussion

Let’s now delve into the specifics of service line coverage, examining its components, the common scenarios it addresses, and how it integrates within your broader homeowner's insurance strategy.

Exploring the Key Aspects of Service Line Coverage

-

Understanding Policy Exclusions: A crucial aspect of service line coverage lies in understanding what it doesn't cover. Many policies exclude damage due to pre-existing conditions, lack of maintenance, or gradual deterioration. For instance, a sewer line gradually collapsing over years due to age may not be covered, while a sudden break caused by a tree root intrusion might be. Careful policy review is essential.

-

Types of Service Lines Covered: Policies typically include water, sewer, gas, and electrical lines. However, some policies might have limitations on the specific types of lines or the depth of coverage. Always confirm which lines are included under your policy.

-

The Cost of Repair and Replacement: The cost to repair or replace damaged service lines can be substantial, often exceeding several thousand dollars depending on the type of service line, the extent of damage, and location factors (e.g., needing to excavate extensively). This underscores the importance of having adequate coverage.

-

The Claim Process: Filing a claim for service line damage is similar to other homeowner’s insurance claims. You'll need to report the damage promptly, provide relevant information, and likely undergo an inspection by the insurance company. Documentation is key, including photographs and any records of previous maintenance or inspections.

-

Bundling with Homeowners Insurance: Many insurers offer service line coverage as an add-on to a standard homeowners insurance policy. This can offer convenience, but it’s vital to compare the costs and coverage limitations against purchasing a separate policy.

-

Separate Service Line Warranty vs. Insurance: It's important to differentiate between a service line warranty and service line insurance. A warranty often covers a specific period and may have limitations on the types of damage covered, whereas insurance provides broader protection.

Closing Insights

Service line coverage is not a luxury, but a vital aspect of comprehensive homeowner protection. Ignoring this aspect can lead to significant financial burdens if unexpected damage occurs. Understanding your policy's coverage, limitations, and the claim process is critical for preparedness. Comparing options between bundling coverage with your homeowners insurance and purchasing a separate policy is highly recommended. Ultimately, securing appropriate service line coverage ensures peace of mind, knowing you are protected against the hidden costs associated with maintaining your property's essential infrastructure.

Exploring the Connection Between Preventative Maintenance and Service Line Coverage

Preventative maintenance plays a crucial role in reducing the likelihood of service line failures and potentially mitigating the impact of covered events. Regular inspections of your service lines, particularly sewer lines, can help identify potential problems early, allowing for timely repairs and preventing larger, more costly damage. This preventative approach can positively impact insurance claims by demonstrating responsible property management. For instance, a policy might exclude damage caused by known pre-existing conditions that were not addressed through maintenance, highlighting the importance of diligent upkeep. However, even with meticulous maintenance, unforeseen events like tree root intrusion or ground shifting can still cause damage, emphasizing the continued importance of adequate service line coverage.

Further Analysis of Preventative Maintenance

| Action | Benefit | Potential Cost |

|---|---|---|

| Annual Sewer Line Inspection | Early detection of cracks or blockages, preventing major disruptions and costly repairs. | Relatively low |

| Regular Water Line Checks | Identification of leaks or corrosion before they lead to significant damage. | Moderate |

| Tree Root Removal Near Lines | Minimizes the risk of tree roots intruding and damaging underground pipes and cables. | Variable, can be high |

| Professional Inspections | Thorough assessment of the condition of all service lines by qualified professionals. | Moderate to high |

FAQ Section

-

What is the average cost of service line coverage? The cost varies based on several factors, including location, type of coverage, and the insurer. Contacting several providers for quotes is recommended.

-

Is service line coverage included in my standard homeowners policy? Usually not. It's often an optional add-on or a separate policy. Check your policy documentation carefully.

-

What types of damage are typically excluded? Common exclusions include damage caused by pre-existing conditions, neglect, normal wear and tear, or improper installation.

-

How do I file a claim for service line damage? Contact your insurance provider immediately. You'll need to report the damage, provide necessary documentation (photos, etc.), and cooperate with any inspections.

-

What is the difference between service line insurance and a service line warranty? A warranty typically covers a specific period and may have more limitations than insurance. Insurance offers broader protection and can cover unexpected events.

-

Can I purchase service line coverage after damage occurs? Generally, no. You typically need to have the coverage in place before damage occurs to be eligible for a claim.

Practical Tips

-

Review your homeowners insurance policy carefully: Pay close attention to the service line coverage section or lack thereof.

-

Obtain quotes from multiple insurance providers: Compare costs and coverage levels to find the best value.

-

Consider purchasing a separate service line warranty or insurance policy: This may offer more comprehensive coverage than an add-on.

-

Perform regular inspections of your service lines: Early detection of problems can prevent significant damage and costs.

-

Maintain thorough records of service line maintenance: This documentation can be crucial in the event of a claim.

-

Understand your policy's exclusions: Know what is and isn't covered to avoid unexpected expenses.

-

Contact a licensed insurance professional: They can help you understand your options and choose the best coverage for your needs.

-

Document any visible damage immediately: Take clear photographs and notes as soon as you notice a problem.

Final Conclusion

Service line coverage is a critical component of comprehensive homeowner protection, often overlooked but potentially life-altering in the event of unexpected damage. The information presented in this article highlights the importance of understanding your policy's coverage, the costs associated with service line repairs, and the steps you can take to mitigate risk and ensure adequate protection. By proactively reviewing your coverage, understanding the nuances of your policy, and incorporating preventative maintenance, you can safeguard your property investment and avoid the substantial financial and logistical burdens that can result from unforeseen service line failures. Don't underestimate the importance of this often-overlooked aspect of your homeowner's insurance. Make informed decisions today to protect your tomorrow.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is Service Line Coverage On Homeowners Insurance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.